The supply chain, which refers to all the ways goods move between companies on their journey from raw materials to finished products delivered to customers, being priorly strained for years due to chronic underinvestment in U.S. ports and railroads, as well as the “thinning out” of logistics companies to their bare minimum in response to Wall Street profit demands, was shocked by a massive drop-off in demand due to COVID-19, when logistics and manufacturing companies reduced production, fired workers, and changed patterns (for example, by sending lots of ships & containers loaded with PPE to Africa and S. America), resulting in dislocations aggravated by the Suez Canal disaster, the difficulty in hiring port workers and truck drivers in the U.S.’s strong labor market, and the lack of international passenger flights to move freight by air, so that when demand bounced back in H2 2020, there was limited capacity, creating an inflationary cycle of doublings, tripling and now 10x-ing of the price to move goods from China to the U.S., meaning difficulties for small businesses in particular to get their goods in a timely fashion, and delays and price increases for customers, with no sign of letting up before the 2021 holiday season.

What Does This Mean For Wellness Businesses?

Most leaders of new wellness businesses The Unwinder talked to manufacture their products in the U.S.. However, most also said that at least some of their ingredients come from overseas. Many raw ingredients in supplements are simply not made in the U.S., and must be imported, often from Asia.

In the lead up to today’s supply crunch, wellness products makers were already feeling difficulties getting raw materials from China.

Wilson Lau, the CEO of California-based nuherbs, noted that COVID-19 simultaneously increased the demand for immune-benefiting supplements, while also increasing costs to farmers and suppliers due to safety measures and labor demand. Heavy summer flooding in China’s agriculture regions wiped out crops. As such, prices were rising by the second half of 2020, and by the beginning of 2021, pressure on shipping began.

Looking at the filings of publicly-traded wellness product companies, we can see the effects of these supply pressures on their numbers. In may, Nature’s Sunshine reported supply chain issues cost them 60 basis points on their net profit margin. For a company with Q2 GAAP net income margin of 6.2%, this is a meaningful hit (and one likely to get worse in the second half of the year).

Peloton faced the supply crunch earlier than most, as the pandemic induced demand for their bikes. The company’s shipping times grew to 5x longer than pre-pandemic norms, forcing them to spend $100M extra on freight (including using airplanes) to keep their customers happy. Peloton has since invested over $800M to do more manufacturing domestically.

Some wellness executives note that this tight, intense climate raises the risk of adulteration in wellness products, as U.S. companies are forced to move to second-tier suppliers to get their hands on raw materials. Stefan Gafner, PhD and chief science officer at the American Botanical Council, shared information with NutraIngredients that in some of the data they see, adulteration of raw ingredients is increasing.

Supply Chain Issues In The Unwinder Community

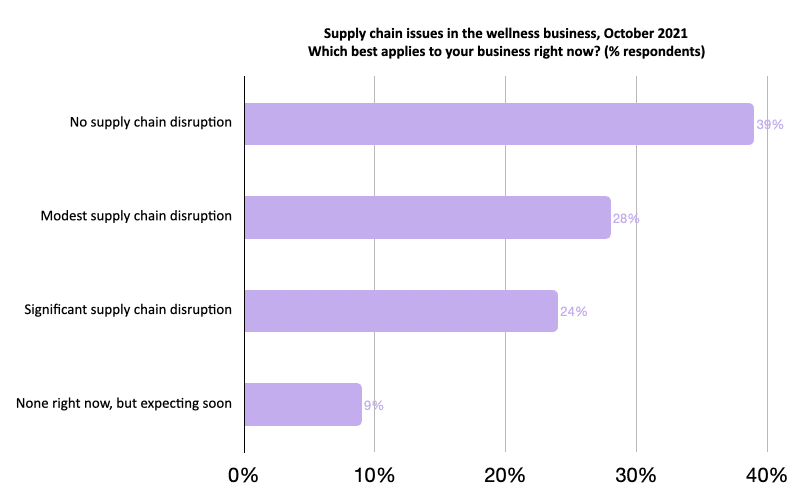

Last week, we sent out a quick poll to the ~250 C-level leaders of wellness companies on our email list. Responses varied, but over 60% either have or expect supply chain issues.

These problems are not unique to the wellness industry. An October ’21 U.S. Census Small Business survey found that 45% of businesses said they are having supplier delays, and Accenture found 94% of Fortune 1000 companies see the same. Overall advice for businesses of all types applies well to wellness product makers.

So, What To Do?

Communicate: Your customers can be understanding, but only if you level with them up front. After the massive disruption of the pandemic, people know that things are still getting back to normal. Communicating up front about potential shipping delays can ease customer service issues. Giving customers the opportunity pre-order products for future delivery lets you manage sales on a more flexible time frame. Communicating well turns bad news into an opportunity to deepen a customer relationship.

Diversify: While the current wave of issues will pass with time, they provide a reminder that crises happen and businesses must be prepared. U.S.-China trade relations seem more likely to get worse than get better, as for political reasons, the line between “competitive frenemies” and protectionist trade policies is hard to walk. Therefore, using this opportunity (over the next year or so) to reach out and meet multiple potential suppliers for key materials will provide resilience against future shocks.

Analyze: Take this opportunity to improve data visibility, for example in forecasting sales growth and conversion rates from advertising. Ensure that advertising ROI remains profitable in a rising-cost world.

Manage: This is also a moment to think about other risks to your business. Make a list: what are the potential disruptions that could happen to the business? How would you weather them? If anything, COVID-19’s impact on the global economy reminds us how interconnected we all are, and how, over a lifetime, one-in-a-hundred events will happen.

News & Notes

The Vitamin Shoppe is adding CBD brand Prima to its retail selection. Founded by Christopher Gavigan, a co-founder of The Honest Company, the brand will appear in The Vitamin Shoppe’s 575 U.S. locations, as the retailer pushes deeper into CBD.

The FTC may be cracking down on the use of product endorsements, specifically on social media. A list of over 2,000 companies received warning letters. Here’s the law site JD Supra with the inside baseball.

The Neu Co. leads a story by Harpers Bazaar about the rise of functional wellness fragrances.

In good news for ashwagandha, a recent randomized-controlled study found that KSM-66 ashwagandha extract improved self-reported symptoms of menopause.

A fascinating study out of Vanderbilt University presents some of the strongest evidence yet for the power of the mind-body connection. The study found a strong association between immune-inflammatory markers and predisposition for clinical depression. (Interestingly, anti-depressants also show usefulness in Covid-19 patients, through the suppression of inflammation).

An important study for the parents out there finds that children recover from concussions nearly 5 days faster if their screen time is limited.

MaryRuth’s Organics announced a voluntary, proactive recall of their Liquid Probiotic for Infants product due to an issue with one of their manufacturing partners. To date, no adverse events have been reported by consumers. Similarly, natural snack bar maker Bobo’s recalled some lots of their bars due to suspected peanut contamination. The lesson? A proactive strategy can build trust, and extensive quality control is key.

Amanda Chantal Bacon, the well-known (and ironically surnamed) founder of Moon Juice, released her second book “The Moon Juice Manual” with Penguin Random House.

Hello Bello, the baby product company of Kristen Bell and Dax Shepard, this week opened their Texas-based diaper production factory, saying this makes the brand the only one to produce its diapers in the U.S.

Impossible Foods is expected to raise a fresh $500M in funding at a $7bn valuation.

Landmark study out in Science, as covered by the NYT, overturning long-held assumptions about metabolism and weight.

Tero Isokauppila, founder of Four Sigmatic, discussed with the NYT managing Gen Z.

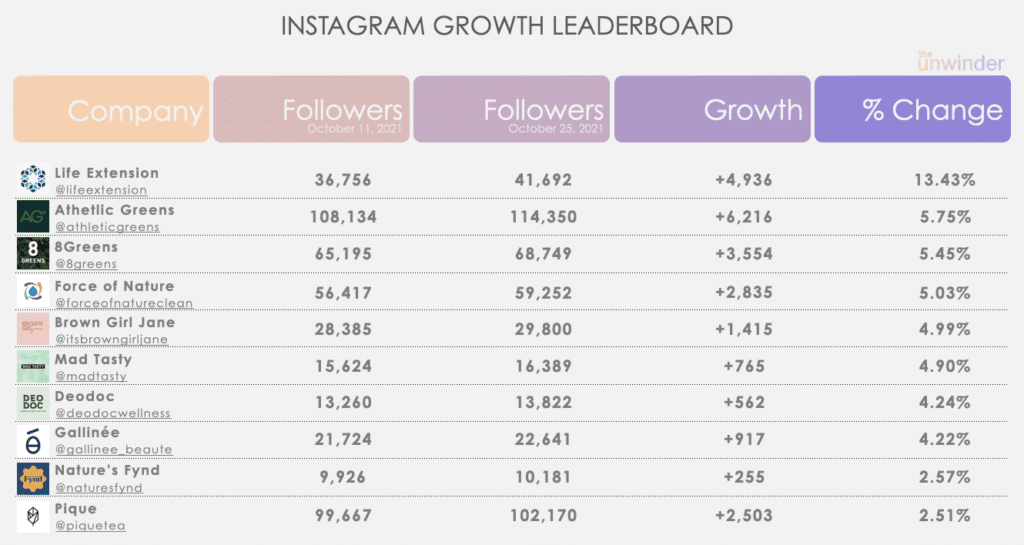

Social Growth Leaderboard

A lot of turnover and some familiar logos this week. One notable trend? Fast-growers Athletic Greens, 8 Greens, and Pique are all big podcast advertisers.