In our past two issues, we discussed the e-Commerce and the Traditional Retail sales channels for supplements and wellness products.

There is, however, a third set of channels that make up 24% of wellness product sales. This guide is about the three largest of the Alternative Channels: Practitioner / Professional Sales, Hospitality Sales, and Network Marketing Sales.

The Practitioner & Professional Sales Channel for Wellness Products

Practitioner sales are made by professionals in wellness, from doctors, physical therapists, and chiropractors, to holistic medicine practitioners, massage therapists, and nutritionists. Before the rise of specialty supplement stores like GNC, and the inclusion of wellness in mainstream retailers, practitioners were a leading channel for marketing and selling wellness products.

Some large supplements firms, like Metagenics, rely exclusively on the practitioner channel, while others, like Thorne Healthtech, started there but have since expanded to a multi-channel strategy.

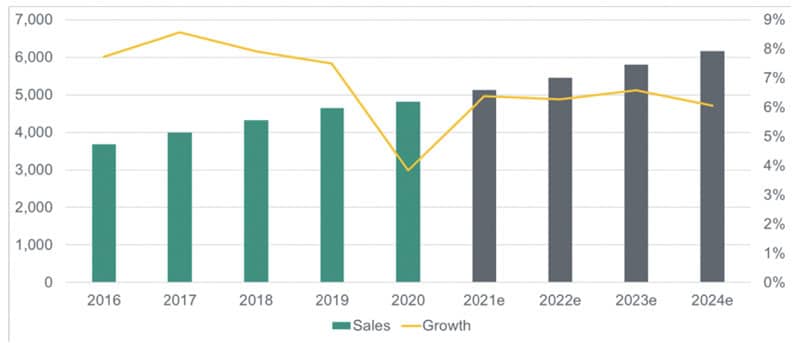

The practitioner channel is the second-fastest growing in wellness products, after e-commerce:

The practitioner channel took a big hit during the COVID-19 pandemic, as patients held off on in-person care. This has since bounced back, and is buoyed by a further trend towards greater use of integrative medicine. Alternative medicine was a $21b revenue industry in 2021, up from $14.3b in 2016. Thorne HealthTech’s S1 said their professional channel sales grew 40% over the past three years. Anecdotally, younger doctors are more open to prescribing supplements and other alternative health practices.

One 2018 survey estimated that between 175,000 and 250,000 health care professionals sell supplements, and that 53% of M.D.s and D.O.s currently do so. (The sample on this study may have representation issues, however).

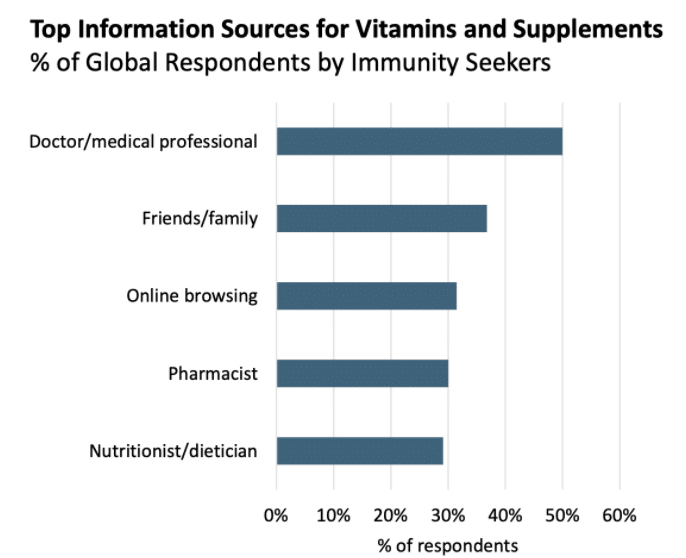

The channel works because consumers trust their healthcare providers. In a survey of nearly 22,000 Europeans, a surprisingly larger number of health-conscious consumers reported getting information from a medical professional, versus online.

Also, while supplements sold through the practitioner channel have the same limits on claims as those sold online or through retail, FDA regulators are thought to value a “learned intermediary” like a doctor, in dispensing advice about wellness products.

This space has not escaped notice of multinational companies, with Nestlè buying Atrium Innovations, maker of practitioner-sold wellness brands, for $2.3b in 2018.

Overall, the practitioner channel is one less-explored by new wellness brands. What matters to the practitioners is trust, and that can take time to build. Yet, today, offline follows online, meaning trust built online (coupled with rigorous science and manufacturing practices) may be the next key to unlocking professional-driven sales.

Hotels & Hospitality Sales

After a huge drop-off in travel due to COVID-19, the hotel industry is roaring back, at +35.6% over 2021 levels. Hotels have always been a source of sales for personal care products, like soaps and shampoos, but increasingly hotels are focusing on wellness to stand apart.

The pandemic has also shifted consumers into a more wellness-focused mindset, with a World Tourism consumer survey showing that 78% of travelers think about wellness in their travel plans. Prior to the pandemic, hotels found that health-conscious travelers spend 130% more than the average guest.

So, this opportunity is wide-open for wellness brands. Travelers want more wellness, hotels want more wellness-focused travelers, and the tourism market is growing fast post-pandemic.

There are multiple ways in to a relationship with a hotel brand. Larger and more experience-focused hotels have their own buyers on the lookout for amenities to improve their guest’s experiences. These folks do attend trade shows looking for fresh products. For food and beverage items, like those placed in a mini-bar, hotels often go through their F&B provider. There is an online marketplace, Top Hotel Supplier, connecting brands to hotels. And good old-fashioned sales can work in this channel, especially with new, up-and-coming hotels.

In any case, a strong pitch as to how your product will enhance the guest experience is crucial, from design and aesthetics to function. Bringing a strong social following certainly won’t hurt either. Public Goods, for example, with 218K IG followers, has 800+ business partners and now gets 60% of their B2B revenue through the hospitality channel.

The hospitality channel is not limited to hotels, and can include restaurants, offices, and luxury apartment buildings. In these premium settings, a partnership can mean not only revenue, but valuable visibility and marketing as well.

Network Marketing Channel

Network Marketing, also known as Multi-Level Marketing, works by recruiting individuals to become retailers of a product.

On the plus side, network marketing can empower entrepreneurs, take advantage of real relationships and word-of-mouth (think Tupperware parties), and eliminate retail and distribution costs. On the dark side, too many MLMs have tipped over into pyramid schemes, meaning they derive more revenue from selling “start up” packages to would-be entrepreneurs than they do selling their actual product to end customers.

Herbalife exemplifies the controversy well – with over 2.3 million independent distributors of their supplements, the company captured $5.5b in 2020 revenue. However, controversy has followed the company, from a $200m fine stemming from an FTC accusation of pyramid-scheming, to serious side effects and lawsuits.

That all said, network marketing makes up ~15% of wellness product sales today. Large wellness-focused MLMs like Herbalife, Nature’s Sunshine, Nu Skin, and Medifast all reported record earnings in 2021.

Like any sales channel, there are ways to do it right and ways to do it wrong. Brand ambassadors, social influencers, and true word-of-mouth are things every brand should strive for, working with partners in a true spirit of partnership, where everyone benefits and the end goal is getting great products to people who need them.

News & Notes

Deepak Chopra signed on to advise The Healing Company, a new $200m shell set up to acquire ~15 wellness and supplements businesses over the next three years.

🥜 KIND is out with a counterintuitive marketing campaign suggesting people don’t eat their bars, in favor of whole foods.

Sephora, Bloomingdale’s and Nordstrom are moving into the sexual wellness category, featuring brands like Maude and Dame Products, reports the NYTimes.

🥊 Thorne and the UFC (Ultimate Fighting Championship) announced the extension of their marketing partnership.

🌫️ In a different take on mental wellness-tech, Paraclete has raised $1.5m for an employer-focused platform.

Plant protein brand KOS raised a $12m series A funding. SPINS data says KOS is the fastest-growing plant protein brand in certain categories.

☣️ An MLM weight loss shake brand Isagenix is being sued for poorly-formulated and labeled products causing vitamin overdoses.

🏋️ FitOn, a “MasterClass”-like company where celebrities teach fitness and wellness courses, has raised $40m.

The COVID-19 pandemic continues to affect businesses in myriad ways. Vegan snack company Livia’s reported they were forced to shut down due to pandemic-related issues.

🪄 The Fresh Factory, a manufacturing partner (also known as a co-packer), has launched an accelerator program for aspiring wellness food and beverage entrepreneurs.

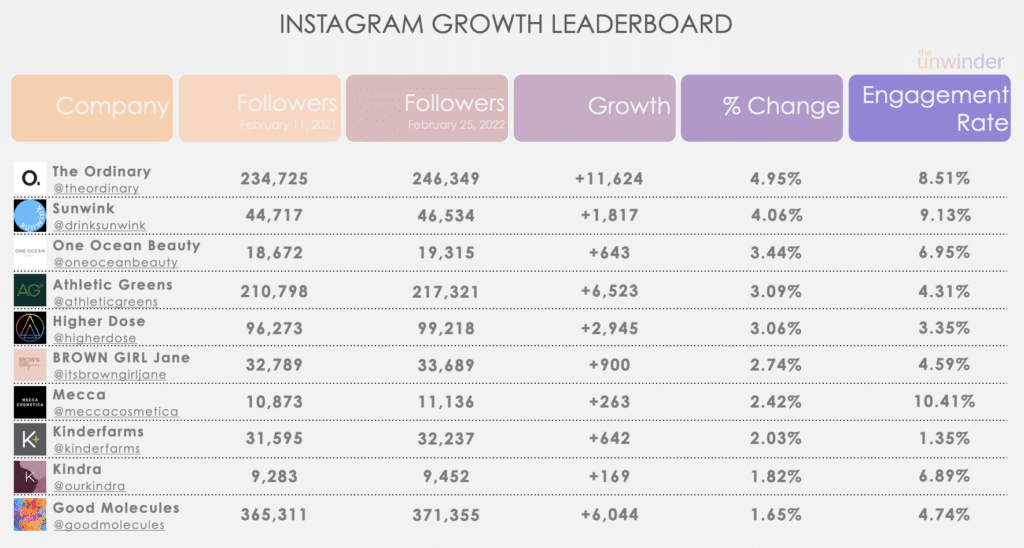

Instagram Growth Leaderboard

Sunwink, last week’s top performer, flipped spots with The Ordinary, last week’s #2.

Congrats to Kinderfarms and Pique on the new handles. You momentarily broke our data collectors!