Hi there, happy every-other Wednesday. Our next three newsletters will focus on sales channels. The goal is to go from 30,000 feet to nitty-gritty useful insights as succinctly as possible. The three channels we will focus on are:

- Online

- Offline / Traditional Retail

- Alternative sales channels

Since we’re right now reading this online, it seems only fitting to start there.

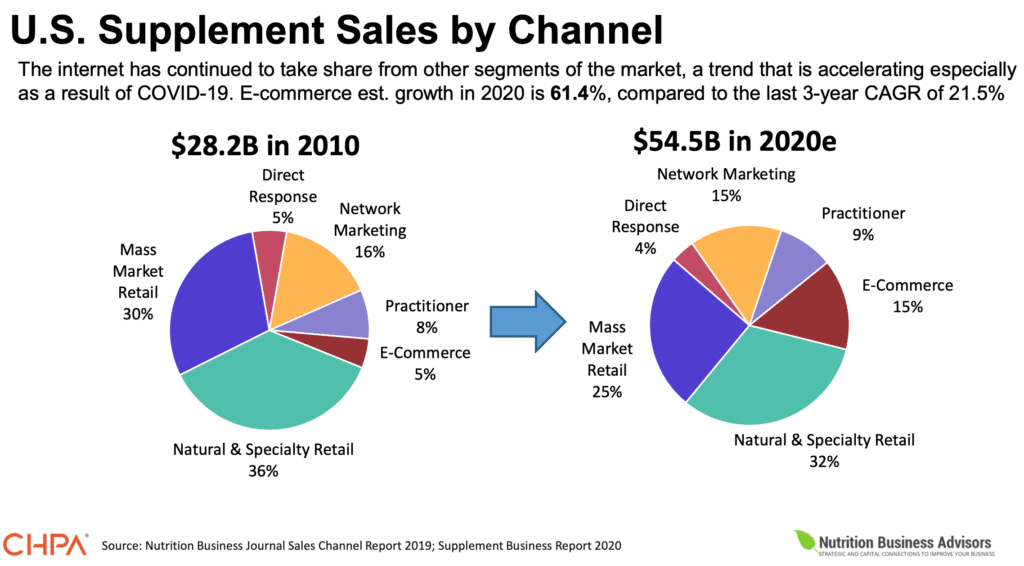

Wellness Products Online Sales Channel Breakdown:

Online sales channels, or e-commerce, are no doubt the most exciting part of the wellness industry. The ability to connect directly with your customers, without anyone in between, enables brands to build new and perhaps lifetime relationships. Online has allowed a panoply of new brands to launch and flourish. While it is important to remember that while “brick and mortar” is still the significant majority of all U.S. retail, e-commerce is the future, projected to grow at nearly 18% YoY.

How Big Will The Online Channel Grow?

Online health and wellness product sales increased $19.22 billion in 2020 and will increase another $39.56 billion through 2024.

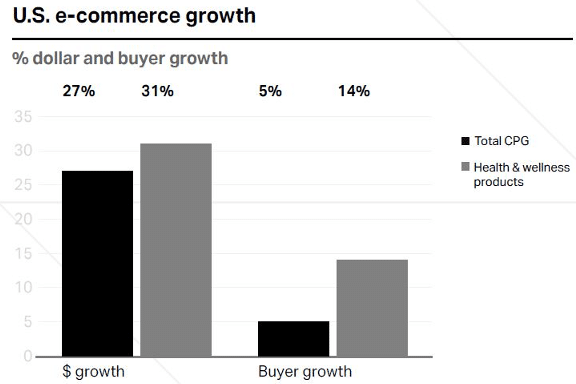

In fact, the health and wellness category outpaces CPG as a whole in terms of e-commerce growth rates:

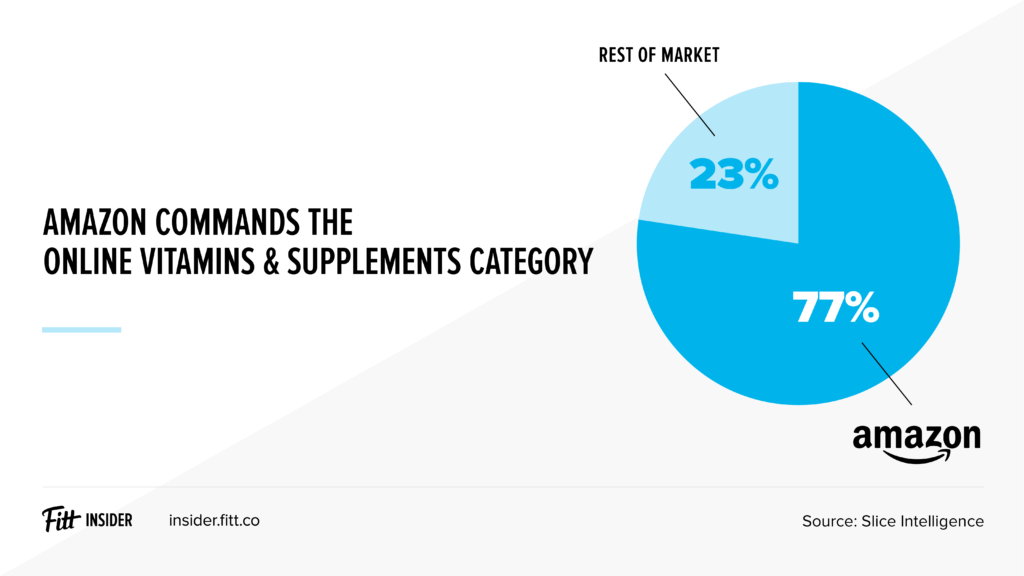

How Much Of E-Commerce Is Amazon?

While brands focus on their DTC strategy, Amazon is still the 800 pound gorilla of e-commerce, commanding 77% online vitamins and supplement sales.

How Do Ad Rates Effect E-Commerce?

For brick-and-mortar, the recipe is “buy wholesale, sell retail” – in other words, stores buy from brands at a discounted rate, and sell to their customers at a full rate. The difference is their net revenue. Online, a brand is most often selling direct to consumers (either truly directly or through a platform). Here, the brand can sell directly at full retail price, but there is no free lunch – platform fees and, mostly, advertising eat into the profit margins.

Advertising spending is growing, projected to be +12% in the U.S. in 2022.

Amazon Ads

Amazon, for example, is quickly becoming an advertising giant, as consumers lock-in to their platform with Amazon Prime and fast shipping, and brands need to stand out from the crowd. Last year, 73% of brands on Amazon bought advertising, up from 57% a year earlier, based on a survey of 1,000 e-commerce businesses.

Those who do spend report spending a large amount – the majority spend over $40K per month on Amazon ads:

However, they do it for a reason. 83% of Amazon advertisers claim at least a 4x return on ad spend (ROAS). Amazon’s Sponsored Products ads are found to drive the highest ROAS, while the Amazon DSP, which buys ads on websites that drive back to the brand’s Amazon page, have the lowest return.

It could be that Amazon is returning such incredible ROAS because it is new. Note that Amazon’s DSP service, which is their only product that competes with other ads on the web, offers the lowest returns. As Amazon ads “fill up” CPMs would rise and ROAS would fall, as it has for channels like Facebook.

Social Ads

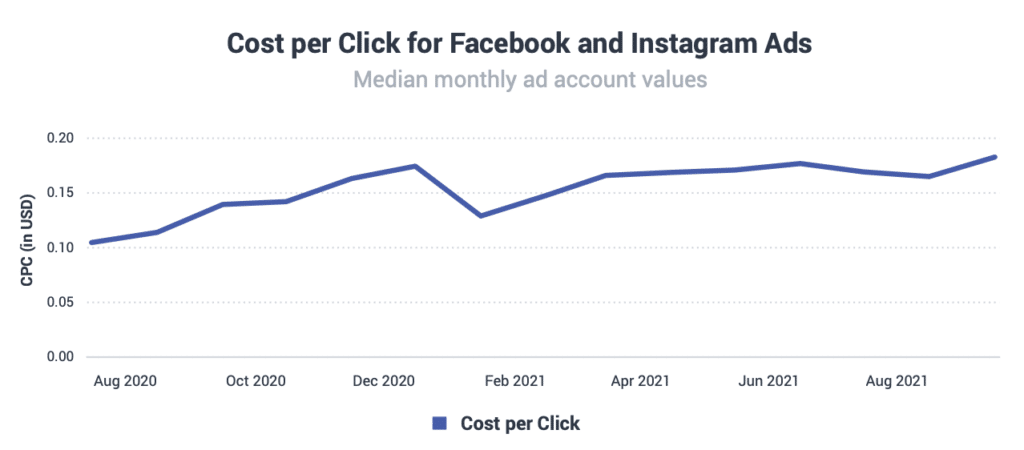

Social ads present a more mature market than Amazon ads, particularly on Facebook properties. As brands have spent more and more on Facebook ads, the laws of supply and demand have caused the prices of those ads to rise:

The average advertiser in North America is spending about $7.5K monthly on Facebook ads.

Search Ads

Like with other established ad types, the CPCs for Google Search Ads have increased 36% YoY (into 2021).

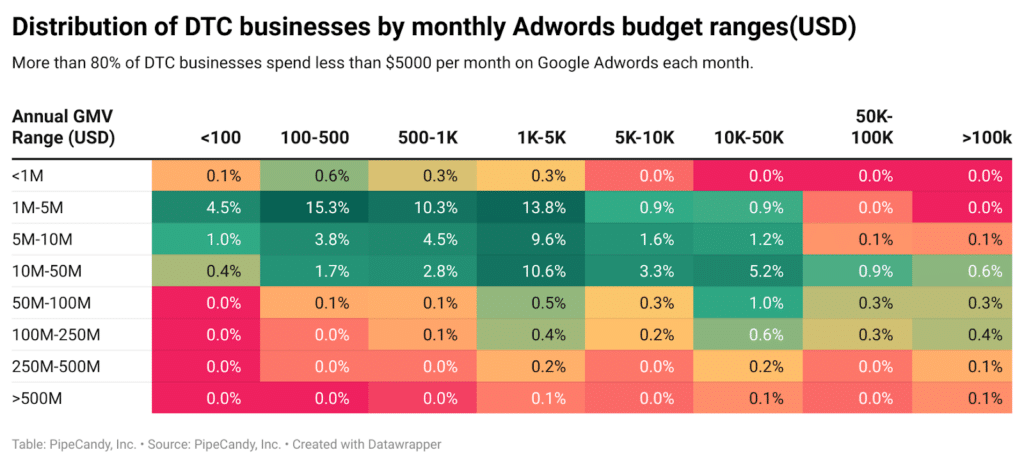

Here is some interesting data from PipeCandy comparing the size of a DTC brand with how much it spends on Google Ads per month.

In a similar range to Social and Amazon ads, most brands are spending less than $5K per month on Search ads.

Conversion Rates & Abandonment

As if things weren’t hard enough in the e-commerce channel, after paying for all those ads, a brand has to optimize their conversion rate, and lower shopping cart abandonment.

Unfortunately, online shopping conversion rates have decreased nearly every year since 2018.

The two biggest reasons potential customers abandon a cart is added shipping costs (60%), and when the website insists on account creation to finalize a purchase (37%).

The Online Sales Channel: Fast-Growing And More Competitive

The thing that makes e-commerce and DTC so great – low barriers to entry, the ability to find your customers around the world instantly, and fast growth – also make it highly competitive.

Online sales are where anyone can start, but also where brand momentum matters more than ever. Advertising can be most expensive for those who are just starting out, or who offer a single product. As your brand grows, each click presents more options to buy, while increased brand recognition makes those clicks cheaper.

Online sales are clearly the future, and mastering them key for any wellness product company. But they are not the only game in town. Next week, we will run through the latest on the Traditional Retail sales channel, with some insights on how to master that.

News & Notes

Athletic Greens has raised $115M at a $1.2b valuation. The company reportedly is north of $150M annual revenue.

It can be nice to hear that acquisitions happen outside of the mega-huge deals that make front page news. RightRice, a vegetable-based rice brand, was acquired by The Planting Hope Company for $7M.

In a bid to combat growing issues with adulterated supplements, Gaia Herbs announced that the company has received ISO certification for 24 of their in-house testing processes.

In more celeb-wellness news, Vital Proteins has brought on Addison Rae, of 40M Instagram and 86M TikTok followers.

Green Roads CBD is out with their first brand advertising campaign, focusing on how CBD can help their users with common health and life issues. The ad agency Known, whose clients include Netflix, Google, and Beyond Meat, put together the campaign.

Olipop has made it to Target stores nationally. This follows Golde’s foray into Target announced earlier this month.

The watchdogs are after Goli, related to purportedly-unsubstantiated claims that their apple cider vinegar gummies lack the same benefits as liquid ACV.

Katy Perry has launched her own alcohol-free wellness aperitif, called De Soi. Prior analysis from The Unwinder showed celebrity wellness brands performing well, but we shall see if this trend continues as the market becomes more saturated.

A randomized controlled trial (the gold standard) finds that vitamin D and long-chain omega 3s are effective in reducing autoimmune disease in people over age 50.

More in regulation – the Advertising Standards Authority is after Oatly for its advertising. The ASA claims that 4 out of the 5 environmental claims Oatly makes in recent ads are factually inaccurate.

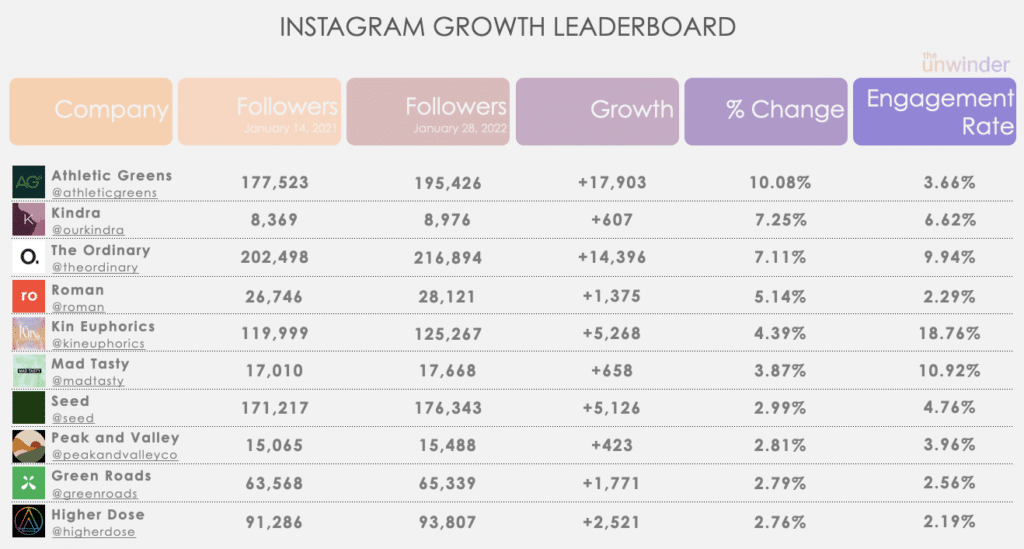

Instagram Growth Leaderboard

This is a first – our top 3 remains locked in place, same order. Athletic Greens must be celebrating the fundraise, and Kindra and The Ordinary taking advantage of January’s annual lows in Facebook ad rates.