It is easy to fall into the trap of believing that online is everything. After all, we’re online constantly, our work is online, and every moment we are online, we can be targeted with product ads. If you work in wellness, you’re no doubt targeted with a lot of wellness brands.

This bubble obscures the reality that the vast, vast majority of commerce still happens offline. Good old-fashioned brick-and-mortar will be a force for the foreseeable future.

What has changed is that increasingly, online activity is what leads offline sales. The playbook for new brands is to build success online, through Amazon, Shopify, and/or social media marketing, and then leveraging that into retail stores. In just the past month, online darlings like Olipop and Golde have found their way from Instagram to the shelves of Target. Target has notably been “aggressively” pitching popular DTC brands to come in store.

This strategy makes sense today. In the past, CPG giants like Nestle or Unilever conglomerated hundreds of brands together, and then used that weight to negotiate for shelf space with retailers. In an offline world, shelf space is advertising. Today, DTC upstarts are at the gates. Without the same negotiation heft, what matters is branding. Whole Foods, for example, will test nearly anything. But if a product does not sell well, they’ve lost their only shot.

So, online leads offline. New wellness brands are built online, and then leverage that success into growth through more traditional channels. But how is traditional retail changing, and what might it look like in a decade?

The Slowing Growth Of Retail

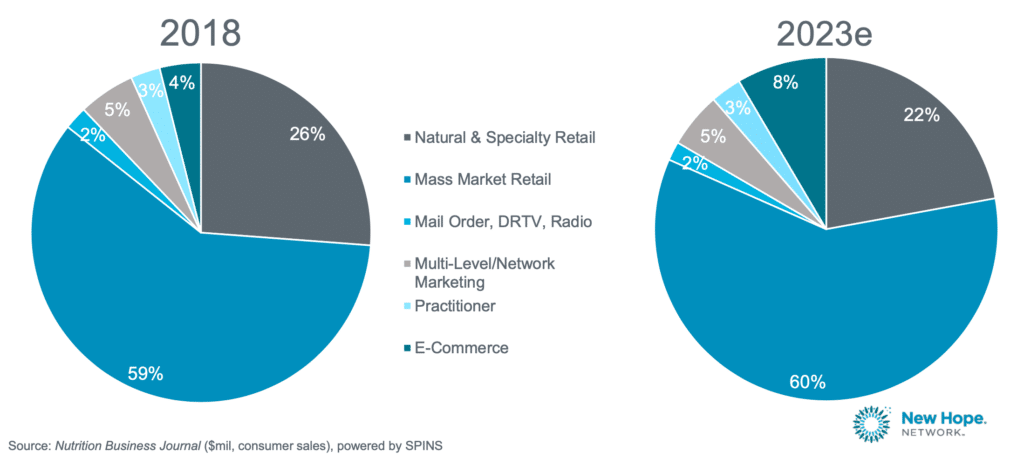

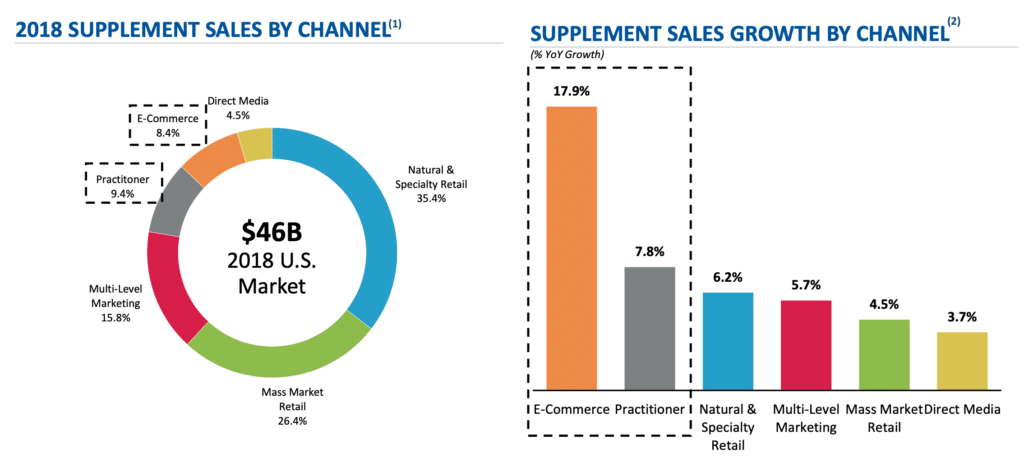

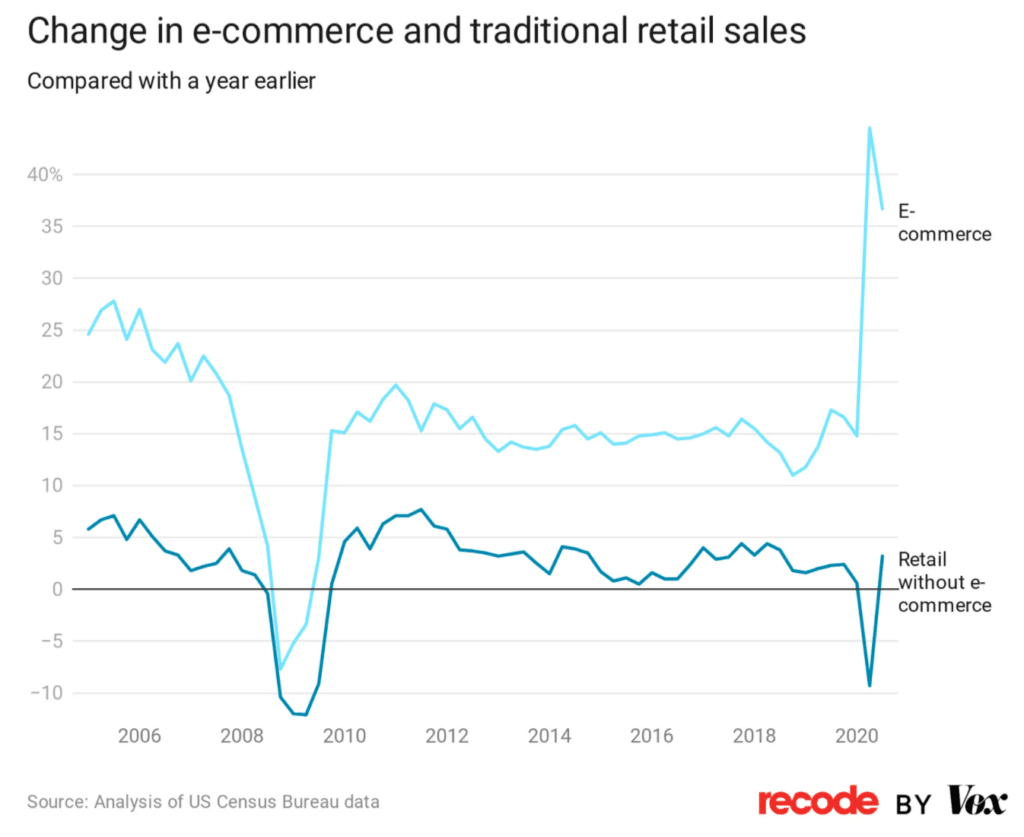

Even before the pandemic, traditional retail channels were growing slower than e-commerce:

The pandemic obviously accelerated these trends:

However, even if we take assumptions that today e-commerce is 15% of wellness product sales and traditional retail 57%, and that e-com will grow 20% YoY and retail only 5%, it will still take until 2031 until e-commerce and retail are neck-and-neck.

How Online Now Leads Offline

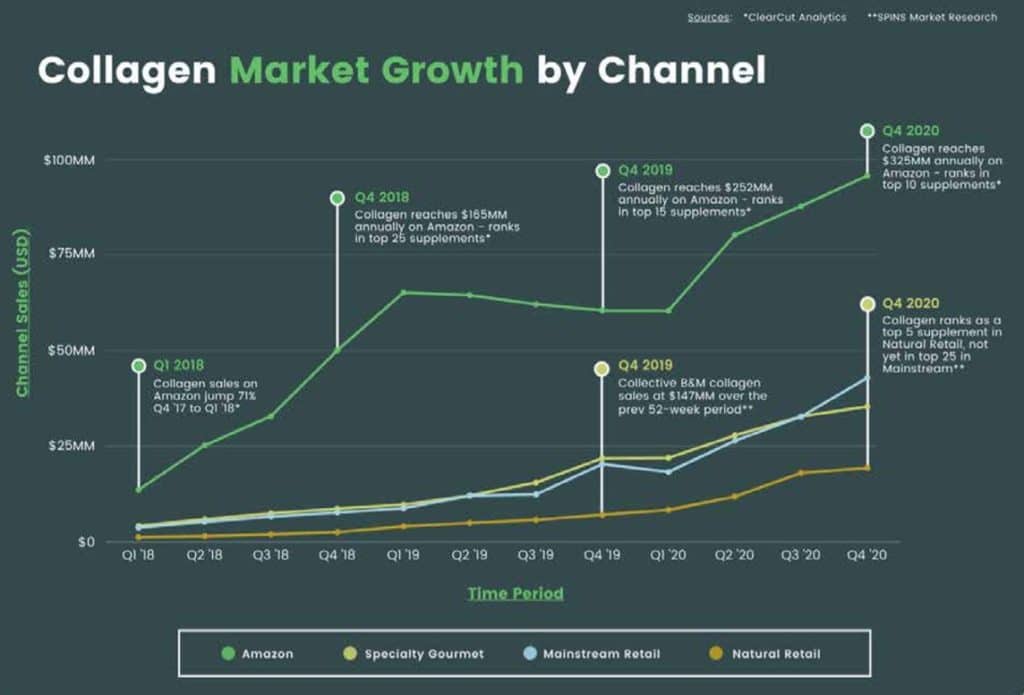

The story of Collagen makes a good case study for how traditional retail now follows online. Collagen started as an online wellness trend – promoted by beauty bloggers, influencers, and entrepreneurs and was sparked by a flurry of new research.

Collagen sales took off on Amazon, and in three years climbed to be a top-10 selling supplement.

Traditional retail, including big box and grocery, specialty stores, and natural foods stores, were late to the party.

Combined, the offline channel now equals Amazon sales for collagen, and there is more room to grow through those channels. But, the online trend started first, and without it, it is doubtful collagen would have been picked up and pushed by retailers as it has been.

Where Retail Sales For Wellness Products Happen

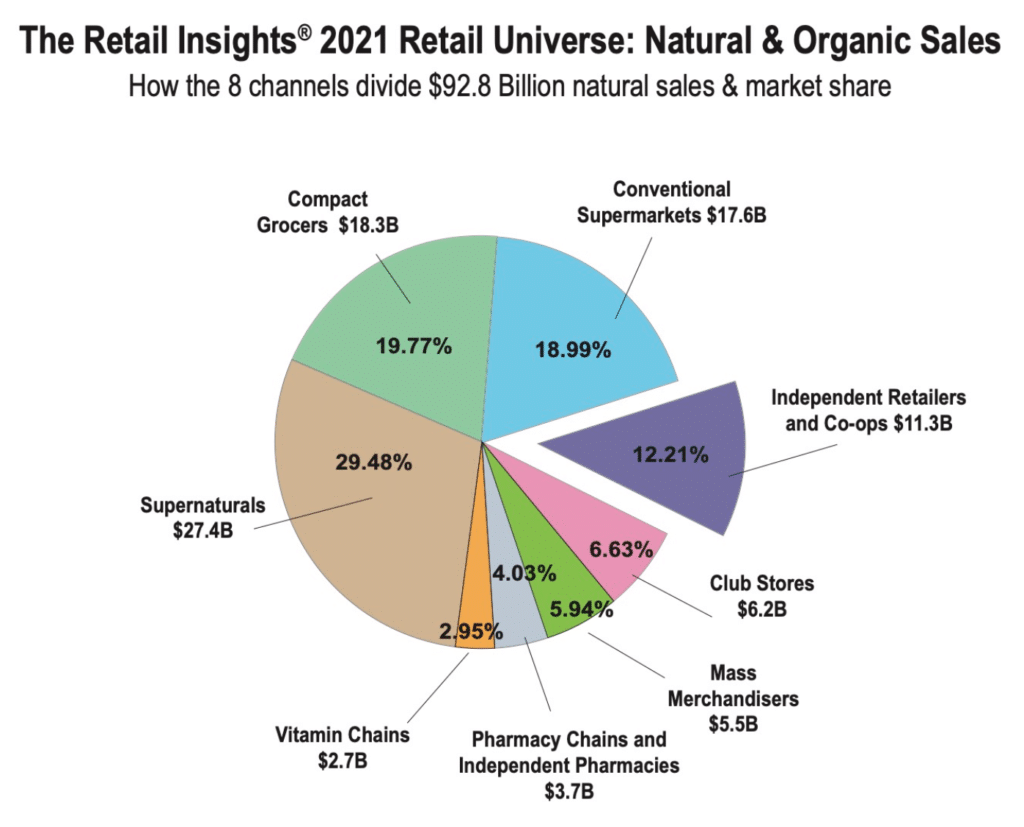

With traditional retail, there are many types of stores. Here is how wellness product sales break down between them. “Supernaturals” refer to companies like Whole Foods:

Those who do spend report spending a large amount – the majority spend over $40K per month on Amazon ads:

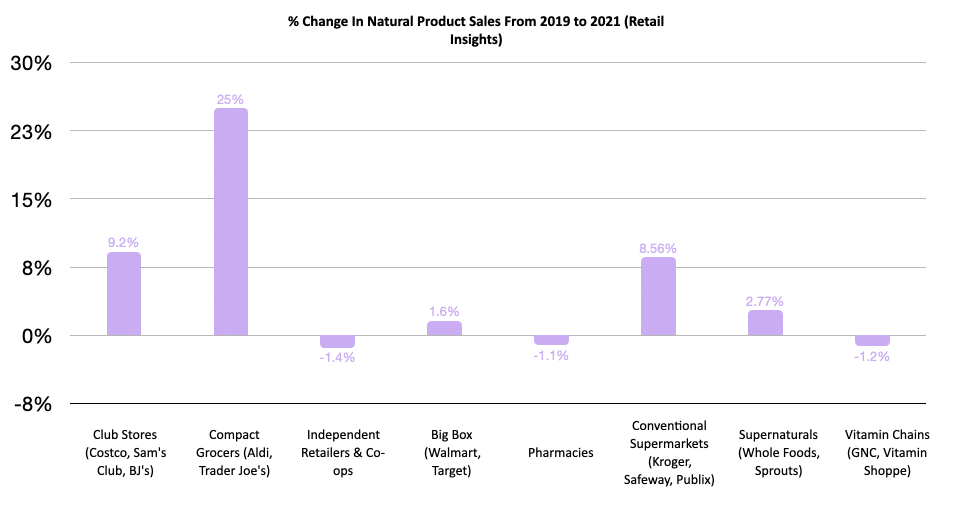

From 2019 to 2021, niche supermarkets like Trader Joe’s have been growing incredibly in terms of wellness product sales, while specialty retailers like The Vitamin Shoppe and GNC have been hit the worst:

In a market where wellness products have been growing north of 10%, these declines are even worse than they appear.

Approaching Retail For DTC Wellness Brands

Pitching, closing, and working with retailers is a big undertaking. Getting a little experience with some local friendly retailers may be useful. Before pitching a big retailer, it is crucial to understand your unit economics. These retailers make their profits by negotiating hard with suppliers in order to provide their customers the best prices. One industry rule of thumb is that manufacturing cost should be less than 20% of the final retail price.

You may want to work with a broker, who maintains these relationships and acts as a commissioned salesperson on your behalf. Also note that the retailers may also get you on shelving fees – these are effectively the “advertising fees” of a brick-and-mortar store.

Your ammo? Proof that people love your products and they will sell. The more brand recognition you have, the more likely a customer will be attracted to your product on a shelf. The stronger a following you have, the more you can direct your followers to a certain retailer to buy your product (and likely more).

In a world of consumer abundance, what matters most is loyal fans, followers, and customers. Big box retailers have less of these – they compete as commodities on convenience and price. In the end, a brand proven online, with true fans, can be priceless.

News & Notes

Maude, a sexual wellness brand, announced that it will be partnering with Sephora on the launch of its intimate care category.

Olipop completed a $30 million Series B funding round, and the brand is now valued at $200m.

Stuart Miller, who has served in leadership roles in the beauty and fashion industries for over 20 years, is the new CEO of Credo Beauty.

Goop has partnered with Uber Eats, so now customers can order up beauty and sexual wellness products on-demand.

Pressed Juicery, a leading cold-pressed juice and plant-based treats brand, recently celebrated the opening of its 100th store.

ADM, the global vitamin manufacturer, released a consumer study showing the top 5 reasons consumers buy supplements, including personalization, convenient formats (like gummies), and scientific claims. Lululemon also released their second-annual Global Wellbeing Report.

The first-ever chia milk will be presented at the Expo West 2022 in California from Seeds of Wellness brand.

Nestlé is buying a majority stake in Orgain, a maker of protein powders, shakes and bars. Nestlé has proven over the last several years to have a big appetite for acquiring new wellness and CPG brands.

Holly Thaggard, the founder of Supergoop!, is in Entrepreneur magazine with a feature. Supergoop! recently landed placement at Ulta.

Splendid Spoon, a women-owned and operated national meal delivery service specializing in ready-made plant-based soups, bowls and smoothies, announces the close of a $12 million series B funding.

Charlotte’s Web announced results of a clinical trial showing CBD’s effectiveness on sleep quality, stress, and feelings of well-being.

Public Goods has had success using hospitality sales – the brands you see at hotels, gyms, and fancy bathrooms – as a channel. We will cover alternative sales channels in our next newsletter.

Instagram Growth Leaderboard

Sunwink makes an enormous leap, after which, things look quite.. Ordinary.

As a reminder, our Engagement Rate methodology is the sum engagement on the past 12 “grid” posts, divided by followers.