It is no secret that the IPO market is currently booming, with more than 940 IPOs in 2021-to-date, an all-time record (however, more than half of these listings are SPACs, which is a whole different story.)

Health and wellness companies are very much part of the IPO trend.

IPOs are interesting for earlier-stage entrepreneurs because they make information public, providing a window into the operations of companies a few stages ahead. These insights come from reading public company filing statements, which disclose financial and operational data and include extensive commentary from management.

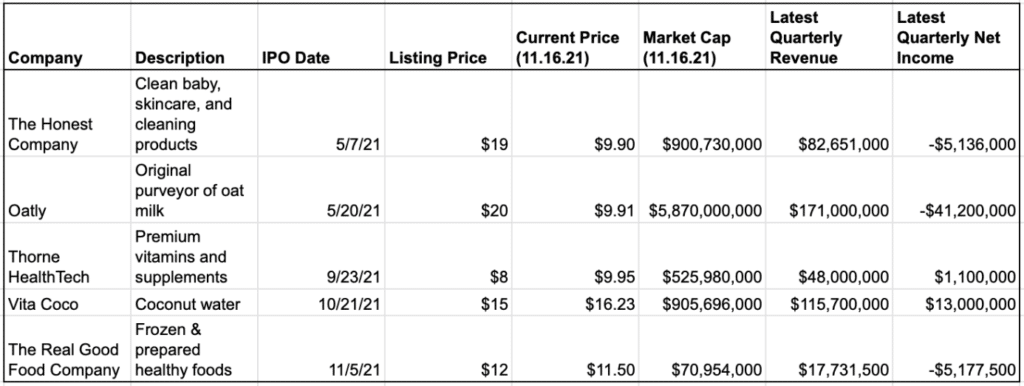

First, here’s a summary of how a handful of recently-public health and wellness companies are doing:

These companies provide a snapshot of wellness-focused IPOs in different categories – beverage, plant-based alternatives, healthy CPG, personal and skincare, and supplements.

For context, up until recently the average 6 month return for a newly IPOed company has been negative. However, in today’s hot market this has flipped, with the average IPO up 75% 6 months post-offering in 2020.

Also note, it is normal for companies to IPO before they are profitable. 80% of IPOs are of loss-making companies. What investors care about is future profits. Over the last 20 years, the magic threshold for a successful IPO whose share price is likely to grow over the next 3 years is $100M in revenue.

Now, we’ll dive in to a few companies that have either IPOed, or are planning to IPO, to see what we can learn about the wellness business.

Thorne HealthTech’s Push To Supplement Subscriptions

Thorne HealthTech IPOed in late September, 2021. Thorne was founded in the 1980s as a high-end, U.S.-based supplement manufacturer, and found their initial success with a distribution model of selling through healthcare professionals.

Today, Thorne is a three channel business. Their largest source of revenue is still professional / B2B-driven sales. Their second channel is direct to consumer (Amazon, etc), and their third and fastest-growing is their subscription program.

The interplay between their subscription growth, and their increasing ad spend, is the most interesting thing we can learn from their public offering documents.

Thorne’s focus on DTC monthly supplement subscriptions has been impressive – a 59% annual growth rate over the last 3 years; currently at 219,000 active subscribers. Note, they offer their subscriptions both on their own website and via Amazon’s “Subscribe and Save” option.

They increased marketing spend from 1.9% of sales in 2016, to 9.5% of sales in 2019. They show that their spending is ROI-positive on a cohort basis (comparing their Lifetime Value to Customer Acquisition Cost), though this breakout (page 82-3 in their S1 Public Filing document) does show some “cohort effects” (meaning that they acquired their most apt customers first, so that cohort has incredible LTV to CAC ratio, while later, less-willing customers show poorer payoff). They also claim early signals that their brand advertising efforts are helping them, and they are engaged in owned content marketing efforts.

Thorne used some of their IPO proceeds to pay off their debt, putting them in a strong financial position. They are also one of the few recent wellness IPOs that are profitable, and whose stock price is up post-IPO.

The biggest thing to learn here is how they are making the shift to subscription revenue. The biggest unknown (which would be hugely helpful to know as a wellness business owner), is the breakdown between Amazon “Subscribe and Save” subscriptions and owned subscriptions, and then what percentage of that advertising spending is on Amazon Ads (as well as the relative churns). This would give a strong signal as to where to start with subscriptions.

The Honest Company Goes Old-Fashioned

We wrote about The Honest Company in the first, private edition of this newsletter. At that time, the stock was down significantly from a May ‘21 IPO.

The issue was a combination of slowing sales and growing marketing costs. The Honest Company, founded in 2011, was one of the first to several trends – clean beauty and personal care, celebrity-driven brands, and strong social media branding. However, the space soon filled up with the “Instagram generation” of wellness companies, crowding the space. They were ramping up marketing spending to spur growth, and the question was – would it work?

It turns out, the company found a third way, as witnessed in their Q3 public earnings release. Revenue grew, though not particularly quickly over 2020, but what was most notable was the shift from Online to Retail revenue. In one year, they moved from majority-online to majority-retail, with retail revenue growing faster than the rest.

This provides in some respects an opposite case study to Thorne, and one to keep an eye on. There are many ways to drive revenue for a wellness brand today.

What’s Going On With Oatly?

Here’s one your intrepid Unwinder analyst can’t quite figure out: Why is Oatly worth so much more than Vita Coco?

Both companies sell alternative beverages, and both are growing fast (Oatly at a 55% clip YoY). Both have annual revenue in the $400-$600M range. Yet while Oatly is losing ~$100M a year its valued north of $5B, while Vita Coco is making a significant profit and valued at less than a billion.

My best guess is that Oatly is a clear market leader, from a brand perspective, in their category. Their Q3 earnings report claimed that there is more demand than supply for their products, as an issue at their U.S. plant cost them millions in sales. Vita Coco operates in a more mature and competitive market.

Things may be leveling out, however, as Goldman Sachs just upgraded Vita Coco’s stock, while Oatly’s shares dropped 22% after disappointing Q3 earnings.

Other Wellness IPOs Hit Pause

While the market is hot, it’s not all roses for everyone. Multiple wellness brands have delayed their planned 2021 IPOs, for a variety of reasons.

iFIT, the makers of the Nordic Track brand, wanted to ride behind Peloton’s success to an IPO. However, with Peloton shares down two-thirds as we come out of the pandemic, iFIT has postponed. Hydrow, a “Peloton for rowing”, had an IPO planned, so it will be curious to see if they also delay.

The Being Better Co. (dba Nutraceuticals) delayed their IPO on the IPO day. This somewhat rare move suggests that they were struggling to find investors up until the last minute. (If you want some extra interest, check out The Being Better Co’s executive compensation section… the CEO has a free plane. When you go public, a lot of information becomes available!)

Real Good Foods, a maker of good-for-you frozen foods, priced well below their expected range.

Getting To $100M Revenue…

It is hard to draw any sweeping conclusions from these few recent wellness IPOs. In general, companies with more than $100M in revenue have more success IPOing than smaller ones.

However, learning to read public company filings can provide a lot of insight into the operations of businesses a few stages ahead. How you incorporate that into your own strategy is up to you.

News & Notes

Daring Foods, a new plant-based chicken brand, raised $65M led by Founders Fund, with tennis champ Naomi Osaka and NFL-er Cam Newton on the investor roster. Daring Foods also announced their placement in 3,000 Walmart stores.

At the same time, VCs are pouring over $1bn a year into lab-grown meat startups, according to Crunchbase.

Dream Pops, a healthy frozen treat maker, raised $6m to scale up operations in Los Angeles.

Data from Nielsen, the media and advertising measurement giant, shows that clean beauty is taking off – growing at 8% year-over-year while the overall beauty and personal care market get only 2%.

☠️ The head of the Botanical Adulterants Prevention Program gives an interview to NutraIngredients where he warns that the pandemic has been a “field of dreams” for supplement-supply adulterers.

Also at NutraIngredients – an FDA warning letter about marketing claims provides an important case study for all wellness brands. The difference between “structure/function claims” and “disease claims” is a subtle and crucial line not to cross.

Want to market to Gen Z? An AdWeek-Morning Consult study found 36% of Gen Z-ers have made purchases based on TikTok, with TikTok driving as many purchase decisions as Instagram, and more than Facebook amongst the total adult audience.

Meal delivery kits like Purple Carrot are ramping up advertising for their Thanksgiving offerings.

Sunwink co-founder Jordan Schenck scores an interview with AdWeek on making plant-based “the sexiest part of the grocery store”.

The Well grand-opened their 14,000 square foot center in Oklahoma City (proving wellness is not just a coastal trend).

Drama at sea for Gwyneth Paltrow’s Goop Cruise, where the story is… no one showed up.

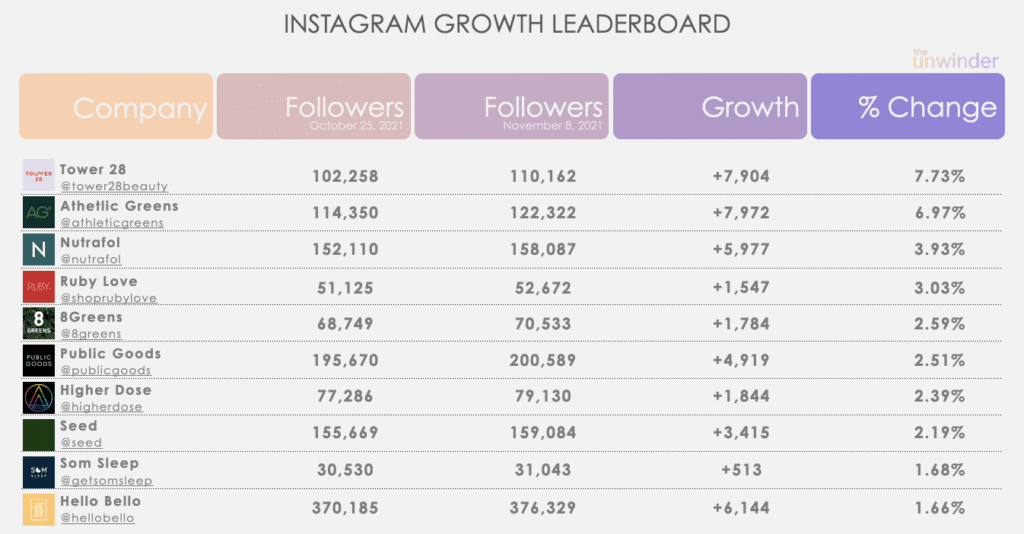

Instagram Growth Leaderboard

Many newcomers to our top-10 chart this week, which analyzes the fastest-growing Instagrams amongst the 250 companies in The Unwinder’s New Wellness professional community.

Good job Tower 28 (clean beauty), Ruby Love (period garments), Public Goods (green cleaning), Higher Dose (infrared therapy), Seed (probiotics), Som Sleep (sleep beverages), and Hello Bello (baby products).