“The Unwinder Pro” Newsletter For New Wellness Companies

I’ve been running this website for two years now, and writing this newsletter for one. I came with experience in consumer tech, digital media, and corporate M&A, because I was frustrated with what I saw as many big unanswered questions in wellness. Like, does this product work? Has it been researched? Was the research good? Where does it come from? Which of the many brands should I buy? I come from a family of doctors and PhD scientists, so I knew enough to know a lot of what I saw on mainstream wellness websites was hooey.

So that was The Unwinder – a combination of Emily Oster, The Wirecutter, and ProPublica for wellness. There are sites doing pieces of this really well, but none pulling it all together in a free, consumer-friendly package.

From a year of deep dives, I realize something unique has emerged on the business side of wellness: a new generation of wellness companies built directly for consumers, on social media and the web, offering new types of products that often challenge conventions. The transformation of what we want (sleep, balance, measurement, personalization) and where we want it (at home, in our phones, with friends and communities) is driven by and manifest in the new wellness industry.

The New Wellness Industry – that’s you. I started this in 2020, and today it sits at nearly 2,000 subscribers, 45% of whom open each edition.

From conversations with founders, feedback on our emails, surveys, data, and original research, 2021 has been a fascinating year for piecing together what wellness companies are really up to. While most “2022 Wellness Trend” pieces focus on what consumers will want, here we’ll focus on what 2022 might hold for those operating a wellness business. As we take stock and plan the year ahead, hopefully this is helpful for those running, marketing, and investing in new wellness.

Before We Jump In…

Help us – what do you want out of this newsletter? We strive to provide original analysis and research for those running wellness product businesses. These were our most popular articles of 2021:

- A Test Of Consumers Shows They Don’t Totally Understand What Supplements They Are Taking. We designed research to contrast how consumers rated their understanding of supplements and wellness products, and how knowledgeable they actually were. Not surprisingly, all consumers overestimated their understanding; even less surprisingly, men were the most overconfident. This research points to a need for better consumer education in wellness.

- A Big Potential Change In The FDA’s Enforcement Of Supplements. Using our analysis of the FDA’s Warning Letter Database, we found a sharp uptick in FDA enforcement actions against supplements and wellness companies with the start of the Biden administration.

- A Deep Dive Into r/Nootropics. An investigatory piece into the self-experimenting Reddit subculture on the subreddit r/nootropics.

- Do Celebrity Wellness Brands Perform Better? We analyzed a variety of marketing metrics for over 250 wellness brands, comparing those with a celebrity founder to those without. Overall, celebrity brands had faster social growth, higher engagement, and stronger SEO profiles than non-celeb brands.

- Wellness Consumption Is Highly Segregated By Income, Age. Our own consumer survey found massive gaps (or, market opportunities) in who buys different categories of wellness products. Unsurprisingly, millennials and the wealthy buy a lot of wellness. Perhaps surprisingly, we found no differences in wellness consumption across racial identities.

Here’s some of what’s upcoming:

- A Deep Dive On Executive Compensation At Wellness Companies

- An Exploration Of The Co-Packing And Co-Manufacturing Business

- A Three Part Series On The Present & Future Of Sales Channels: Digital, Retail, and Alternative

- A State Of Technology Exploration Of Lab-Grown Meats And Personalized Nutrition

We also include News & Notes, a competitive ranking of Instagram Growth, and an uber-curated jobs board.

What do you want more of? More competitive intelligence? More jobs? Specific topics? A weekly frequency? Daily? More emojis? Fewer??

The biggest thing you can do if you’ve gotten any value out of this newsletter is to tell us what you could use in 2022. Just press “Reply”.

Now, on to 2022’s business watch-outs for wellness:

Advertising Rates Go Brrrrr

There are many forces behind the 2010s boom in new consumer products: cloud computing, warehousing and fulfillment as a service, social media, and overseas supply chains. However, none may be more important than online advertising. Being able to reach unique niches of consumers cheaply, creatively, and with measurement allows new entrants to sell products and build brands without the gatekeepers of retail distribution.

This is why rising digital advertising CPMs in 2022 should be on all radars.

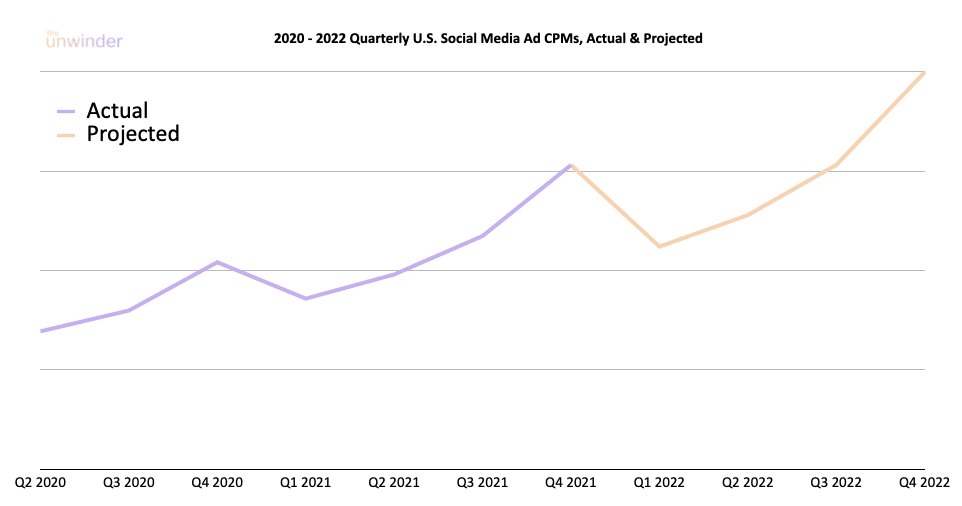

Demand for online ads, and social media ads in particular, came roaring back in 2021, and this trend looks to continue in 2022. Here we combined data from Statista, eMarketer, and Adespresso on 2021 QoQ CPM and CPC growth, layered in Facebook’s Q3 earnings report, and best estimates of 2022 ad spend growth to provide a picture of what 2022 ad rates may look like:

In part, the success of new consumer brands is growing demand for ads, causing today’s rising CPMs. Overall, as we come out of lockdown, demand booms (which is why all agencies project record increases in ad spend in 2022) at the same time that consumers may be spending (slightly) less time with social media, constraining supply. Further, Apple’s privacy changes blocking Facebook’s access to the Apple Ad ID have hurt Facebook’s ability to efficiently use ad inventory.

An early exploration of alternate digital channels, like web, email, and TikTok ads, as well as good old fashioned retail, will be helpful in 2022.

Supply Chain Implications Take Center Stage

There are two types of supply issues for most wellness companies. One is getting your materials, the other is the quality of those materials. It is unclear whether supply chain snarls will ease in 2022; issues of supplement quality are likely only to increase.

In November, Consumer Reports dropped a bombshell report on the adulteration of most spices with lead, cadmium, and arsenic that we covered here. A lot of supplement companies use similar supply chains for their raw materials. In broad strokes, the issue is likely less willful adulteration, and more that plants grown in countries with poor environmental controls absorb and concentrate a large amount of pollutants through the water and soil.

Even U.S. grown products are not immune (I just tested my tap water here in Los Angeles to find it has unsafe levels of arsenic). Needless to say, the fact we have poisoned large parts of our environment means contamination of our products will go from the exception, to the norm. For the wellness industry, this can be a brand- and industry-defining issue.

Social Selling & The Diversification Of Sales Channels Becomes More Crucial

In 2021, we saw ad rates rocket and the share all buying rise to 15% online. However, we also saw companies with unique distribution channels do especially well, whether Thorne Healthtech’s successful IPO off the back of a professional distribution network, or Olly building a system to point customers to available products across channels.

2021 also gave us the biggest year yet for the Celebrity Wellness Founder, showing how in a world of product abundance, attention is the new distribution.

In the beginning of the DTC boom, a Shopify site and some Instagram Ads, or an Amazon store and some good SEO, was all you needed. Now, thousands of DTC brands are launching every year. Sophistication in channels old, like email, web, retail, and resellers, and new, like social influencers, Snap and TikTok ads, subscription, Amazon Ads, and more, will separate the upstarts from the lasting successes in 2022 and beyond.

News & Notes

Moon Juice made Vogue’s list of the best products of 2021.

The private equity Blackstone Group acquired a majority stake in Supergoop!, at a value of around $700M. The sunscreen brand is 15 years old.

Gaia Herbs gets into the gummy game, with a line of 3 plant-powered gummies in stores in January 2022.

Nutrafol, the hair-supplements maker, is said to be exploring a sale in the $1B range. The company was backed by Unilever, among other VCs, and claims revenue around $150M

Thorne Healthtech announced a multi-year partnership with a professional cycling team.

Athletic Greens’ new COO, Kat Cole, discusses how wellness consumer brands can leverage the blockchain to grow community and loyalty.

A report from Grand View Research expects the $44 billion vitamins market to grow by 6.2% annually, to $71 billion by 2028.

A good reminder that EU regulations are different from the U.S.: Luxembourg authorities are investigating a supplements company for interacting with EU residents on Facebook.

Global business research firm Meticulous Research believes the plant-based meat market will grow at nearly 10% annually, to $23 billion by 2028.

Instagram Growth Leaderboard

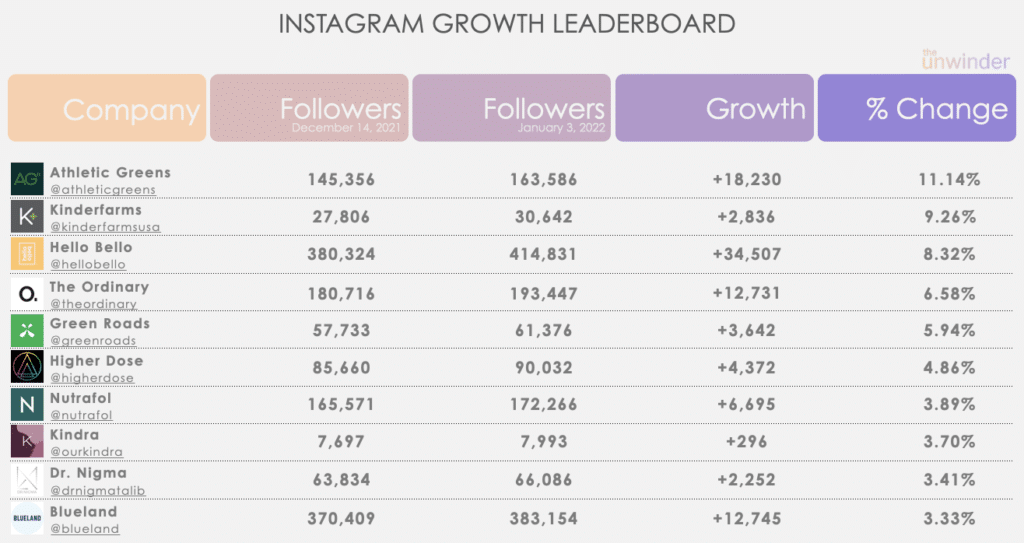

New features are coming to our Growth Leaderboard in 2022, but for now, let’s welcome Kindra, The Ordinary, Dr.Nigma, and Green Roads to the top 10 growers list.

For those curious, the top-10 in Instagram growth for 2021 were: Credo Beauty (389%), Umzu (114%), Kin Euphorics (52%), Life Extension (45%), Force of Nature (41%), Pique Tea (41%), Olipop (35%), The Maca Team (35%), Blueland (33%), and NotCo (30%).