“The Unwinder Pro” Newsletter For New Wellness Companies

In general, consumers are spending more this holiday season than last. One-third of consumers plan to buy more gifts this year because they will be seeing friends and family over the holidays.

58% say they are more comfortable shopping in stores and 32% are less concerned about covid. Most notably, 29% of consumers plan to spend more holiday shopping this year than last, and overall retail sales are expected to grow 3%+ year over year. This growth is primarily driven by affluent shoppers – those who spend $1,000 or more.

Spending On Wellness During The Holidays

Health and wellness is the fastest-growing category by holiday spend. According to Coresight Research ($), 56% of consumers say they will spend more on health products this holiday season, a net gain of 43% year-over-year.

Health spend-intent increased amongst both men and women, though the figure was more pronounced in men, who were +53% for buying vitamins/supplements and wellness products.

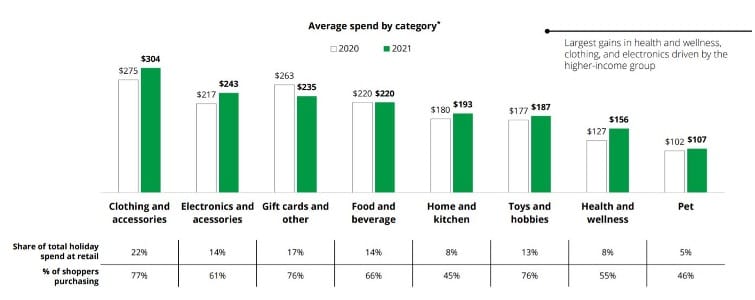

This increase in wellness spending may be coming at the expense of other categories. According to Deloitte’s Holiday Retail Survey, wellness has the biggest year-over-year spend increase, while categories like gift cards, food & beverage, and toys show less growth. Wellness’s share of the holiday wallet is increasing.

Consumer Spending By Wellness Category

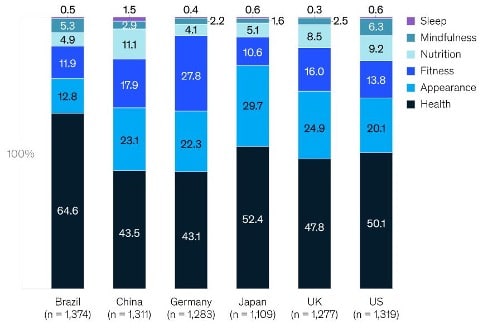

When it comes to where people’s wellness spending goes, this cross-country comparison from McKinsey (April, 2021) is revealing:

Here, “Health” is what we consider traditional health & wellness – vitamins and supplements, as well as those things that the insurance-based health system don’t cover. It is no surprise that in countries with weaker safety nets, this is a larger percentage of total.

American consumers lead the way in mindfulness spending. Significant chunks of the wallet go to fitness, and nutrition, with sleep emerging as a category.

Further, holidays 2021 represents a transition phase from pandemic-driven wellness to a post-pandemic future. According to the Global Wellness Institute, certain pandemic losers may become winners again in an emerging post-covid world. These include wellness tourism, spas, in-person fitness, and traditional & complementary medicine. What lies ahead, we shall see, but what is clear is that this holiday season and beyond should be good for wellness product makers.

EXTRA: A Spicy Warning, Or A 2022 Resolution

A massive Consumer Reports study of 126 herb & spice products revealed shocking results currently making the rounds of popular media.

One third of the products (40 total), had arsenic, lead, or cadmium at levels that pose a health threat to both children and adults. For thyme and oregano, every product Consumer Reports tested had too-high levels of heavy metals. A product being organic or US-made did not matter, arsenic, lead, and cadmium still turned up.

Heavy metal exposure lowers IQ, immune function, and can cause nervous system, kidney, and reproductive, among other issues. The Consumer Reports study is a must-read. It may make you want to throw out your whole spice rack.

How is this happening? Heavy metals can come from pesticides, or most often they are absorbed by a plant via contaminated soil or groundwater. The FDA does not have legal thresholds for heavy metals in most food products, so its up to companies to self-regulate. Most of the spice companies Consumer Reports talked to relied on their suppliers, who are most often overseas, to provide them with heavy metals testing data or assurances.

Why are we writing about this in a newsletter for wellness product creators? Because much of the same situation applies to supplements. Ingredients grown abroad, subject to self-certification, in countries where access to uncontaminated water or soil may not be possible. This issue has cropped up for wellness products before – turmeric from South Asia sold in the U.S. with heavy lead levels, a NY Attorney General 2015 sweep of GNC netting dozens of adulterated supplements.

Our industry should take this as a warning. Test your ingredients. U.S. labs, like Medallion, Element, or NeoGen, offer this type of testing for as little as $200 (Food Safety News has some details on the ins and outs here). The Unwinder has lab-tested products like maca before, and found the process quite easy, perhaps a 2022 resolution for us all.

News & Notes

Jack & annie’s has come out of nowhere with a $23M fundraise and a new approach to plant-based meats. The product uses jackfruit, a meaty tropical fruit with interesting economic and ecologic characteristics. TechCrunch with the big writeup on their approach.

A new study suggests that DHA Omega-3 supplements can significantly boost cognition in malnourished children.

Apothekary, a plant-based health and wellness brand, closed a $3.5 million round. The company projects $10 million in sales in 2021.

Cornell University has developed a tool that will better detect zinc deficiency, which may be useful for the supplement industry as over 1 billion people worldwide suffer from a zinc deficiency of some kind, according to Scientific Reports.

The Natural Products Association, a trade group, is suing the FDA, alleging that the agency has retroactively applied the drug-exclusion clause to ban the popular ingredient NAC, or N-acetyl Cysteine. NAC is used for certain established medical purposes, but has also become a popular anti-Covid compound. While the lawsuit is filed, the FDA has still not “reached any determination” regarding the ingredient’s actual status.

Sage extracts might improve cognitive ability, even during tiring exercises, according to a study conducted at the University of Bourgogne.

Levels, a metabolic biowearable health startup, raised over $6 million on the crowdfunding platform WeFunder, at a $300 million post-money valuation. We’ve written about our experience with Levels here.

Read about how Olly Vitamins sidestepped supply chain issues by embracing good old-fashioned retail.

London-based ThreeDots partners with athlete-gaming brand 4CAST to help its CBD drinks enter international markets. This is the first known partnership between a CBD and a gaming brand.

Sundial Foods, a plant-based meat startup, raised $4 million. The seed round was led by Nestlé, and the company focuses on creating plant-based chicken wings. The two founders previously participated in a Nestle R&D accelerator in Switzerland.

Kin Euphorics gets a big profile in Forbes, noting that interest in non-drinking is growing, and that the non-alcoholic adult beverage space grew 33% last year, to $331M.

Instagram Growth Leaderboard

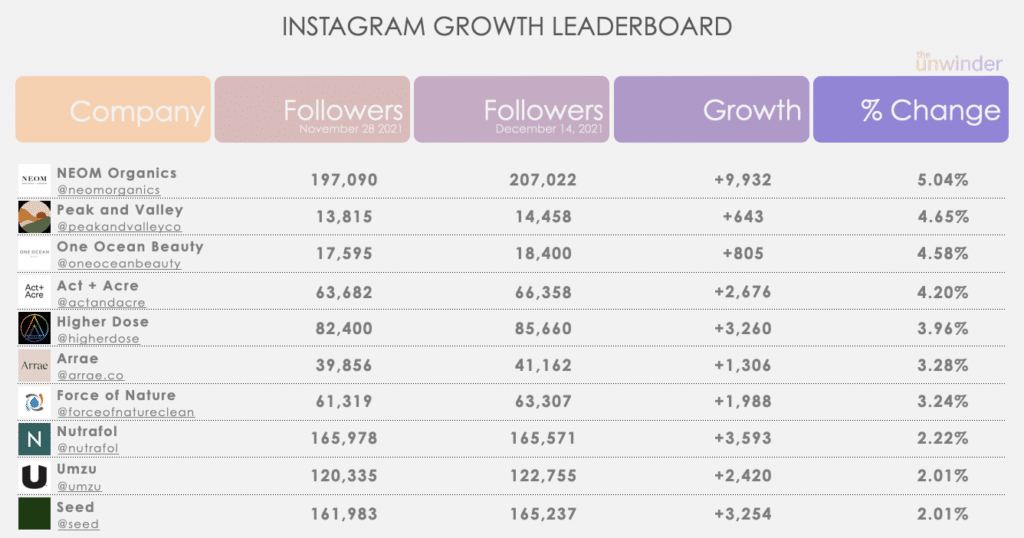

Those holiday marketing dollars continue to show in high rates of IG follower growth amongst our tracked company set. Common faces prevail, though newcomer One Ocean Beauty crashed the list at #3.

Interestingly, Thorne Healthtech came in at #11, after never ranking in the top-100 for growth. Looks like those new IPO dollars are getting to work!