Gen Z is the future of wellness. As the first fully internet-native generation, their habits and preferences diverge from millennials. Now, Gen Z is coming into its own in terms of purchasing power.

Past research on Gen Z and wellness finds they are highly stressed and focused on their mental health. The pandemic brought an increased focus on physical health and mental wellbeing over career and relationships.

They quantify their fitness, they live online and care about looking healthy, and their information comes from influencers and online channels.

The Unwinder builds on this research with a new demographically-representative survey of Americans age 16-24 on their wellness views, habits, and information landscape.

This March 2022 survey polled U.S. mobile internet users age 16-24. The survey panel was weighted to be demographically representative. Given the representativeness of the panel, we are presenting actual, rather than statistically-stratified, results. For more information on this methodology, click here.

The goal was to get a snapshot of current Gen Z attitudes, preferences, and behaviors about wellness, and to compare these results to past research. Here we go!

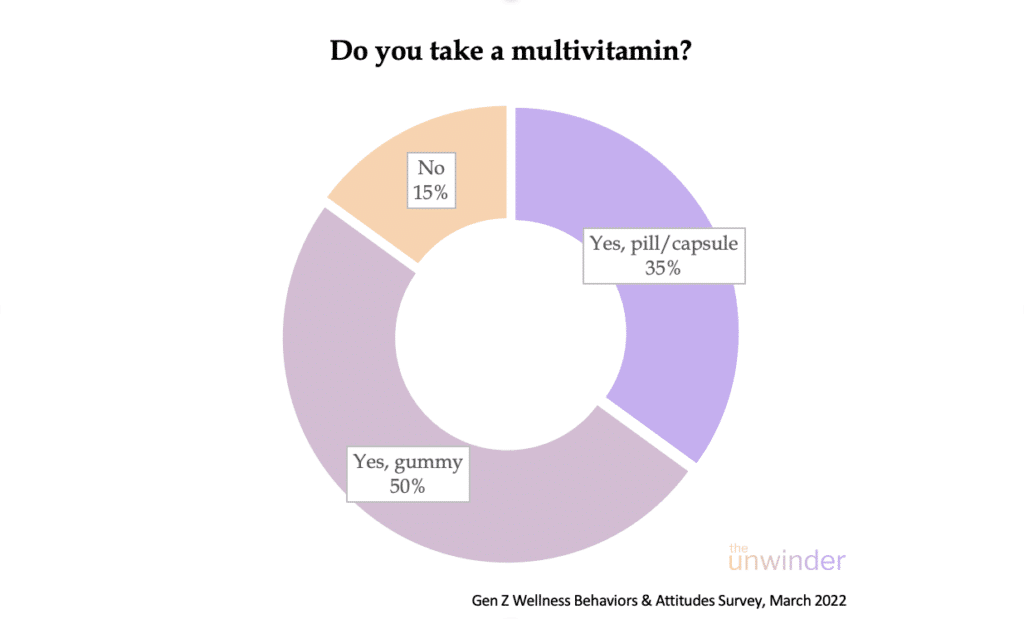

Gotta Be Gummy

First, Gen Z is very into wellness, but less into traditional pills and supplements. If Gen Z is taking a vitamin, its a gummy vitamin:

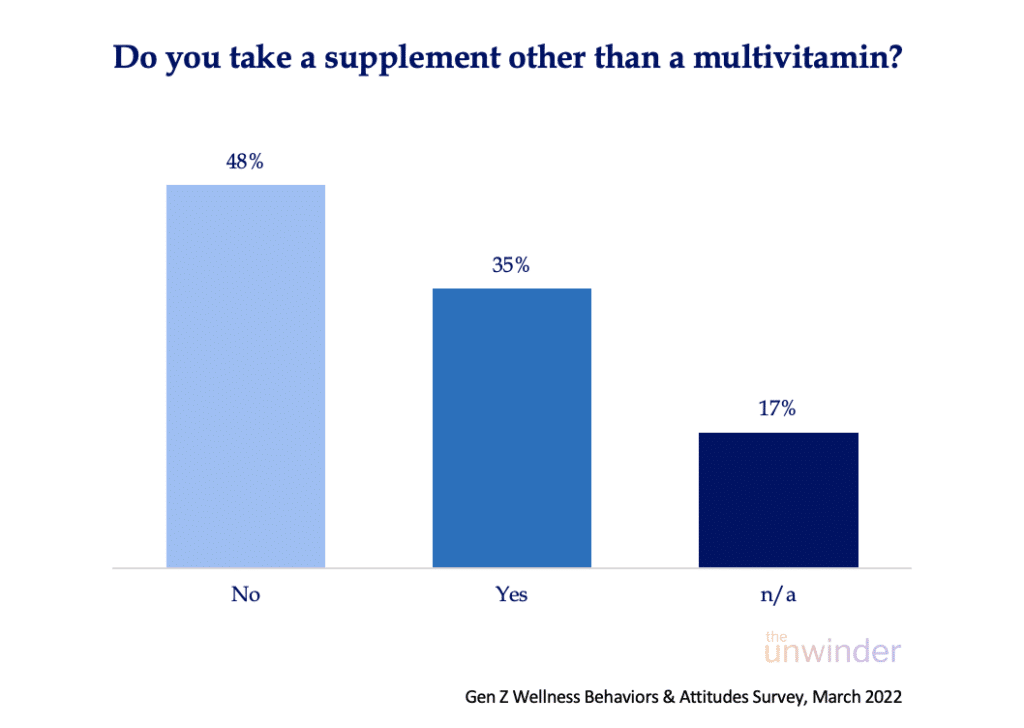

Functional Foods Over Supplements

When you bring up the word “supplement”, most Gen-Zers are out. This concurs with 2021 research showing that Gen Z is focuses more on functional foods and beverages versus pills and powders. By contrast, original Unwinder research in 2021 showed 60-70% of older Millennials, Gen X, and Boomers purchasing supplements of some kind.

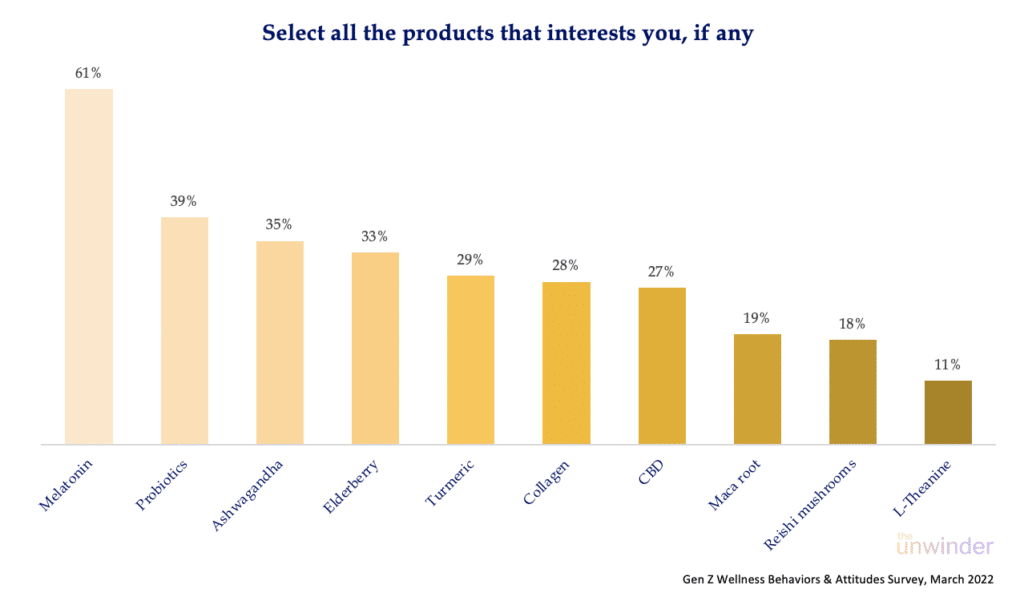

CBD Is Going Out Of Style

What supplements and ingredients are Gen Zs interested in? Sleep and gut health are clearly important. Ashwagandha is surprisingly popular for a somewhat niche wellness herb. Elderberry may be a function of a desire to boost immunity in the pandemic.

CBD is going out of style with Gen Z. In the Unwinder’s consumer study of summer ’21, CBD was far and away the most popular wellness product across audiences. Now, CBD is garnering interest from only 27% of our Gen Z sample.

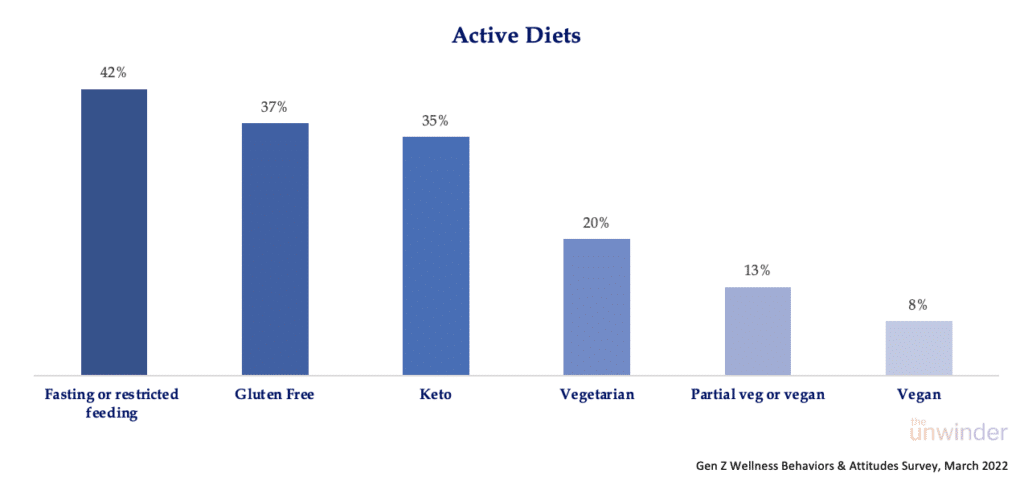

Gluten-Free And Vegetarian Go Big Time

Diet-wise, 25% of the American population restricts gluten in their diets to some degree, while our study shows 37% of Gen Z do. 5% of the U.S. population follows a vegetarian diet, while 20% of Gen Z does. A surprisingly high number of respondents reported some sort of restricted feeding regime – an area that likely requires further research.

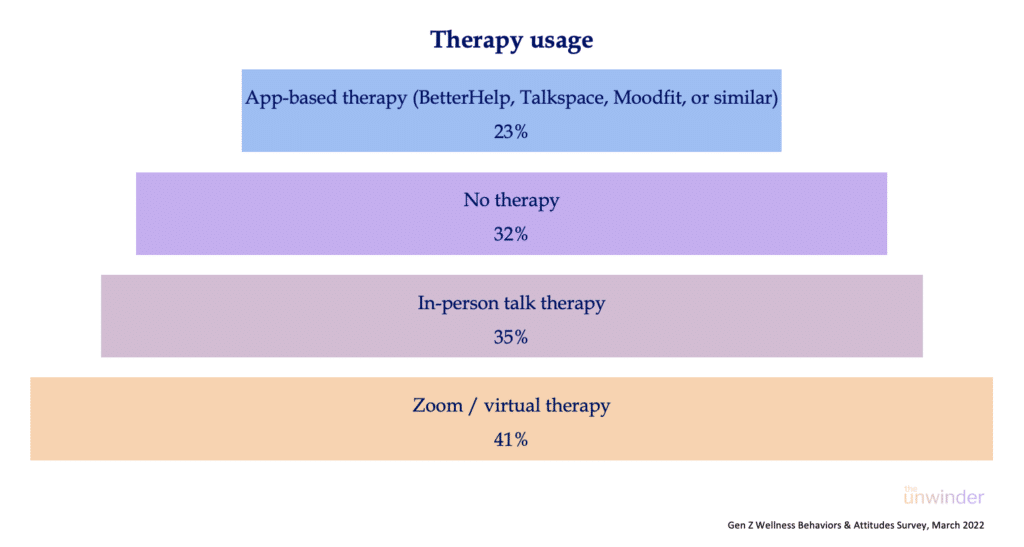

Therapy For All

Gen Z is very into therapy. Popular culture is beginning to term them the “anxiety generation”, as the pressure of financial crises, the pandemic and global warming, all made exceedingly clear through digital media, feeds over 50% of Gen Z-ers reporting some mental health issue. Thankfully, nearly 70% of Gen Z respondents report some sort of therapy. This compares to 16 to 36% for those age 35+ as reported in our Q4 Consumer Survey.

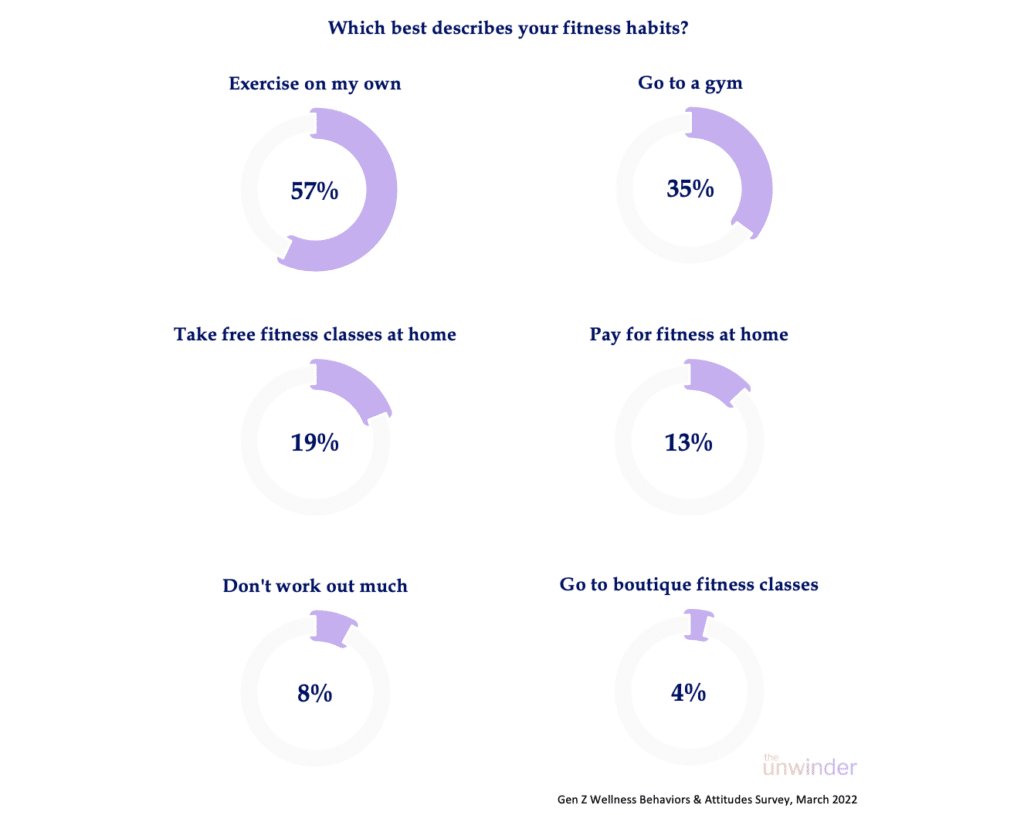

Workouts Are Happening, But Where?

Gen Z is into fitness, though how they do it is disparate. The majority report working out on their own. A surprisingly small percentage do boutique fitness; however this may be a function of funds and transportation versus a long-term rejection of that medium. According to gym giant Les Mills, 87% of Gen Z works out 3 times or more per week.

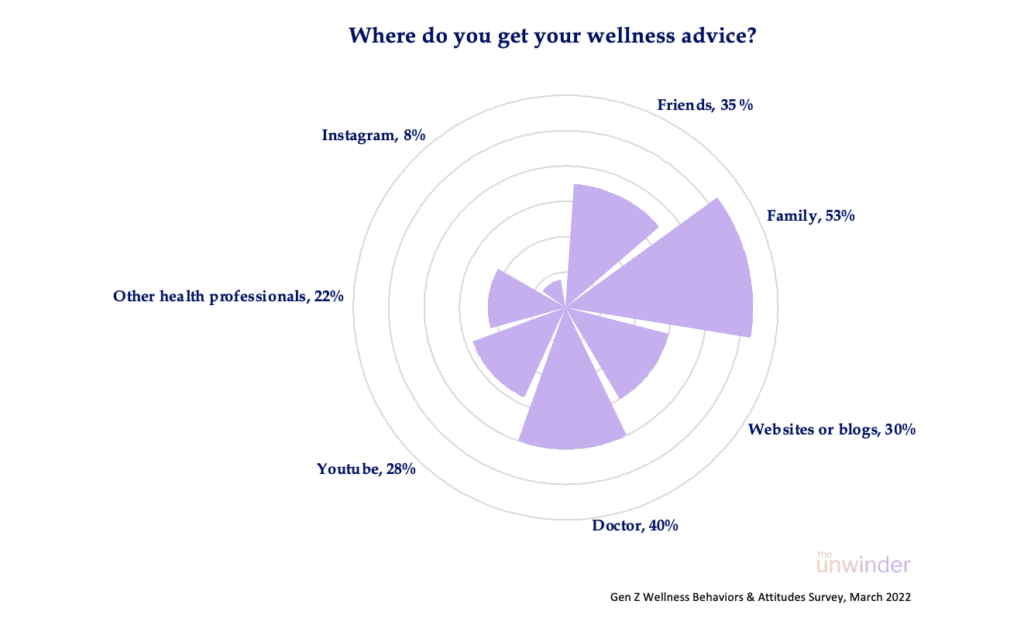

Youtube > Instagram

Lastly, Gen Z does get health information online, however they tend to value multiple sources – this answer had the most “cross over” of respondents selecting multiple categories. Instagram is minor, contrary to our hypothesis, but YouTube is big. By contrast, a large 2019 study showed 55% of respondents aged 25-49 getting health and wellness advice from social media.

We then asked respondents to write in freeform who influenced them when it comes to health and wellness. Here’s what came up multiple times

- Dr. Mike who has 9.3m YouTube subscribers and a very entertainment-forward way of presenting well-established health advice.

- The podcaster Kevin Pho, MD.

- Nikki Blackketter’s fitness Instagram (1.6m followers)

- Sascha Fitness, the Spanish-language YouTuber with 1.88M subs.

- ATHLEAN-X, the 12.5m sub exercise-focused YouTube channel

Overall, these results were sometimes expected, sometimes surprising. I’m left with an impression of a generation that is highly anxious (perhaps as they should be, given how the “adults” are running the world), yet conscientious and focused on wellness. In many ways, I see a generation that is smarter about it than they get credit for. The wellness business will do well to keep up 🙂

News & Notes

🤮 Goop is in the news again for the wrong reasons. The New York Post was out last week with a series of stories about a “toxic” workplace culture that encouraged “cleansing” that made staff, including Gwyneth Paltrow’s second-in-command, feel unhealthy.

Goli Nutrition announced a fresh partnership with Eden Reforestation Projects, a nonprofit working to rebuild deforested landscapes in developing countries.

🩺 Gaia Herbs announced the appointment of a scientific advisory board to guide the company’s development of evidence-backed supplements.

🌫️ In a sign the world of nootropics is coming closer to the mainstream, Life Extension launched a caffeine-free “Brain Fog Relief” supplement.

🥪 Nature’s Fynd is challenging the Beyond/Impossible duo by expanding distribution of their meatless breakfast patty’s into Whole Foods.

Speaking of, Impossible Foods founder is stepping down and handing the CEO role to a former Chobani executive.

🤓 Athletic Greens has appointed Dr. Andrew Huberman, the Stanford neuroscientist and host of the Huberman Lab podcast, one of the top health and wellness pods in the U.S.

🤿 Jointly, a software company for quantified wellness in cannabis experiences, has raised a $5M seed round.

Spot & Tango, a wellness brand for pets, has raised $51.75M.

Crunchbase reports that $13bn in VC flowed to foodtech in 2021, with half that going to animal-free meats and dairy.

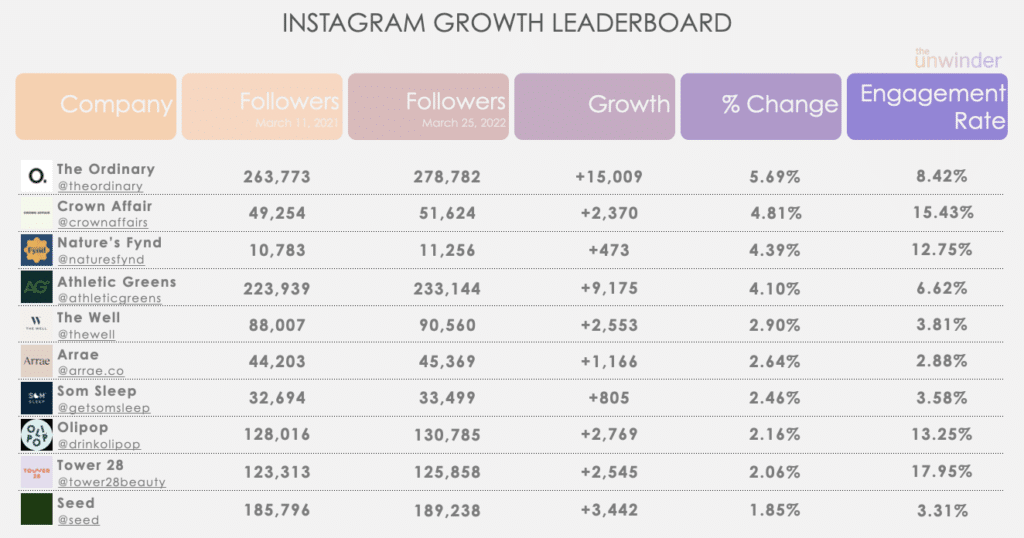

Instagram Growth Leaderboard

The Ordinary leads in growth, with strong engagement, for the 3rd straight week. Nature’s Fynd, new to Whole Foods, also makes our leaderboard on strong engagement.

Sign up for our newsletter for more Wellness Industry Content from The Unwinder.