What Is Co-Packing?

After decades as a background industry, co-packing is suddenly a hot topic. Co-packing (or contract packaging, or co-manufacturing/contract manufacturing) is when a company produces consumer goods, usually consumer packaged goods, or some part thereof, as an outsourced provider for another company.

Co-packing ranges from just the literal packaging of products (wrappers, jars, boxes), to fully-outsourced product development and manufacturing, including recipe development and raw materials sourcing.

Typically, an entrepreneur approaches a co-packer with a product idea. It may be just at the idea phase, or may be a small-scale DIY operation, or a successful product with in-house manufacturing that needs scale. The co-packer’s job is to provide that scale, based on a contract guaranteeing some base-level volume, timing, and prices-per-unit.

Co-packing is exceedingly common in the supplements and wellness business, as the “niche” nature of many supplements and wellness products don’t lend themselves to economically building manufacturing capacity in-house. Even large CPG companies use co-packers for certain product lines.

Why Is The Co-Packing Sector So Hot Right Now (Hansel)?

Co-packing went from an unheralded sector to a word on the tongues of many in the business and entrepreneurial community. This is due to a few factors. Over the last two decades, globalization has meant quick access to cheap and specialized raw materials from around the globe. The internet has then given entrepreneurs direct access to customers, without needing to go through traditional retail channels.

These factors led to the current DTC boom, with niche brands challenging the CPG Giant + Retail establishment axis. A niche brand likely lacks the scale to buy or build a factory, so it makes sense to work with a co-packer. DTC growth = co-packing growth.

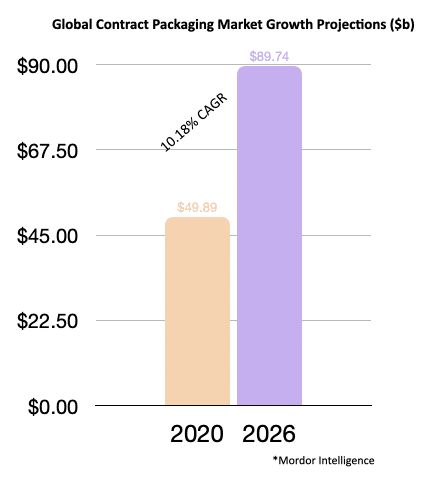

CHART – Global Co-Packaging Growth https://www.mordorintelligence.com/industry-reports/global-contract-packaging-market-industry

The supplements and nutrition contract manufacturing market is currently worth in the $20-$30bn range in the U.S. (against $52bn in U.S. supplement sales in 2021) and is estimated to grow at nearly 11% CAGR globally.

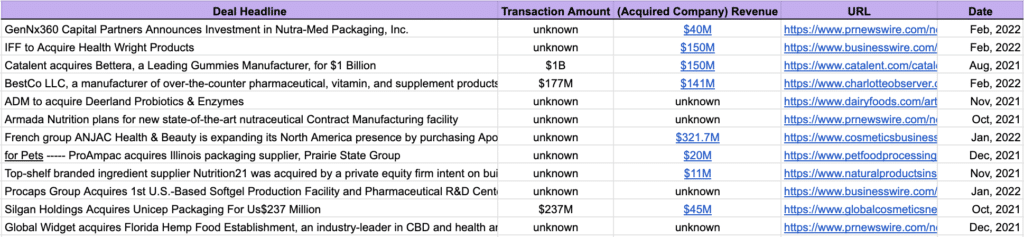

An investment boom is underway in this sector, as investors realize the power of co-packing businesses (as well as a way to get exposure to DTC growth in a diversified way). The Unwinder counted 12 major co-packing M&A deals in the past 6 months:

The valuations of these businesses seem rich. For instance, Bettera, a leading co-manufacturer in gummy supplements, was purchased for $1bn, or 6.7x revenue. In response to this boom, co-packers are laying out more and more capital expenditure to grow their operations.

Why Work With A Co-Packer?

Economies of scale. For the same reason that Amazon Web Services can more efficiently, cheaply, and reliably deliver hosting for your website versus you building your own server racks in your office closet. Manufacturing has big capital costs – to buy equipment, warehouse space, licensing, employees, and more. A co-packer can spread those costs out over many different companies and products, and therefore make more efficient use of them, resulting in a lower cost of production vs. DIY.

Co-packers also generally have supplier relationships, which can help entrepreneurs find the best raw materials, negotiate fair prices, and ship them. Often they will have experts on staff to help with formulation, with particular experience in how to make products that can be produced in large quantities, at high quality, and ship and store well.

Economies of scale are so powerful that even enormous CPG companies like Kellogg’s use co-manufacturing for certain product lines.

Specialization works the other way as well. In a DTC world, consumers have near-unlimited choice, meaning that marketing and community building may be the most important factor outside of product that makes a new brand succeed. Focusing on that, and leaving the manufacturing to a partner, is in the early days likely a good decision.

How To Work With A Co-Packer

The first step is finding one. The Unwinder has put together this list of ~250 co-packers for supplements and wellness businesses.

There are likely thousands of these businesses in the U.S., offering different specialties and flavors of co-packing. For a niche wellness food product, there are co-packers who specialize in that. To scale an already-established brand, or to provide backup and redundancy in a supply chain, a giant co-packer may be in order.

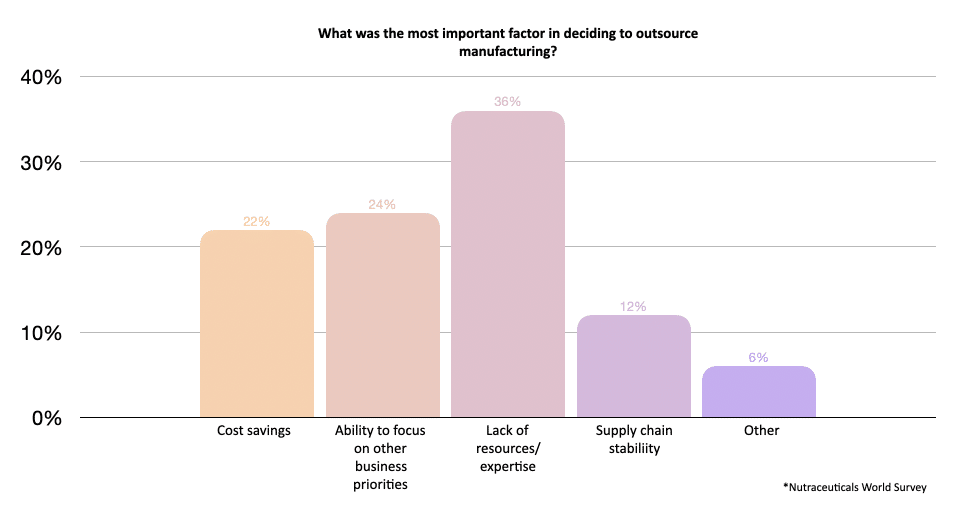

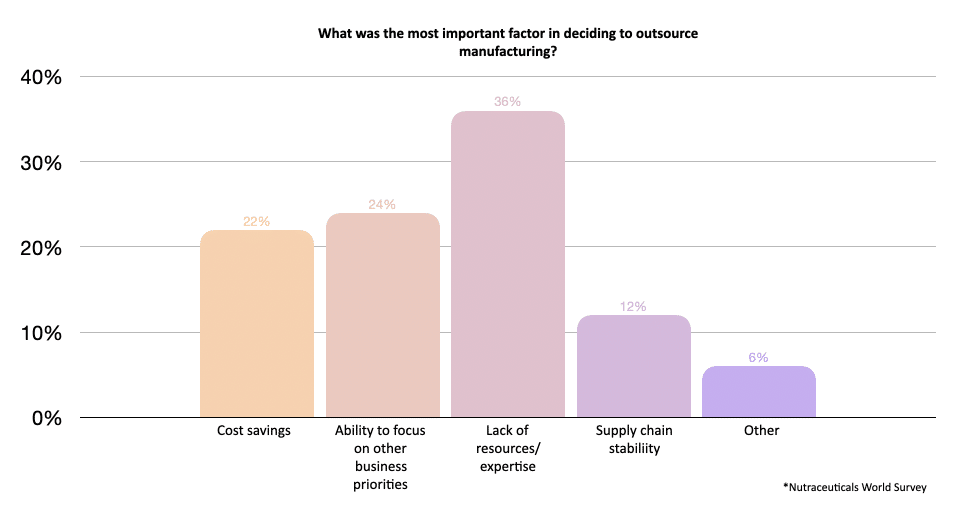

A 2022 survey of 100+ execs in supplements businesses cited a lack of resources or expertise as a main reason for working with a co-packer, alongside cost-savings and the ability to focus on other parts of the business. For reference, over 50% of the surveyed businesses have over 100 employees.

How Much Does A Co-Packer Cost

Cost will vary with the product. Generally speaking, raw material costs will make up around 50% of your finished product from the co-packer. Co-packers generally charge by the unit, though in more highly-manual production processes, or in smaller shops, they may charge a day or hourly rate.

Generally speaking, there will be a minimum run of production (e.g. 10,000 units), but if you are an entrepreneur with a good reputation, or willing to pay consulting fees, a co-packer will generally work with you on test runs.

Here is a very comprehensive guide to how to choose a co-packer, by the government of Alberta, Canada, of all places.

Regardless, running a model of your expected unit costs, your own operating costs, and your customer’s willingness to pay is the formula for your business.

After cost and capability, certification and trust are the most important considerations for co-packing partners. In the U.S., co-packers should follow Good Manufacturing Practices, and be certified as Global Food Safety Compliant. The former is enforced by the FDA, the latter is an industry best-practice. And always use a good lawyer when negotiating key contracts.

If you’re looking to start a wellness product business, or looking for new manufacturing help, check out The Unwinder’s list of XXX wellness co-manufacturers here.

News & Notes

Model and influencer Winnie Harlow raised $4.1m for a new sunscreen line, Cay Skin. The line is inspired by Harlow’s experience growing up with the skin condition vitiligo, and the lack of performant sunscreens for her modeling shoots.

Thorne Healthtech has acquired Nutrativa, an innovative company with technology for 2D-printing dissolvable supplement discs.

Plant-based meats are going private-label, with Kroger announcing that Impossible Foods will supply Kroger’s private-label brand.

Muse, the EEG headset maker, has launched a VR-capable headband, with the idea that measured meditation can now happen in virtual worlds. A toy now; watch this space

Ritual has named longtime ESG-practitioner Lindsay Dahl as Chief Impact Officer.

OLLY is out with a new brand campaign, “Big Vagina Energy”, promoting their women’s libido-focused products.

Herbalife has suspended operations in Russia. The company had 62 sales centers and 44,000 active distributors in the country.

A large-scale study out of Brigham and Women’s Hospital found that people who took vitamin D or vitamin D and fish oil had lower rates of autoimmune disease versus those who did not.

A startup called Givhero, which partners with employers to link employee wellness challenges to local charitable giving, has raised a seed round.

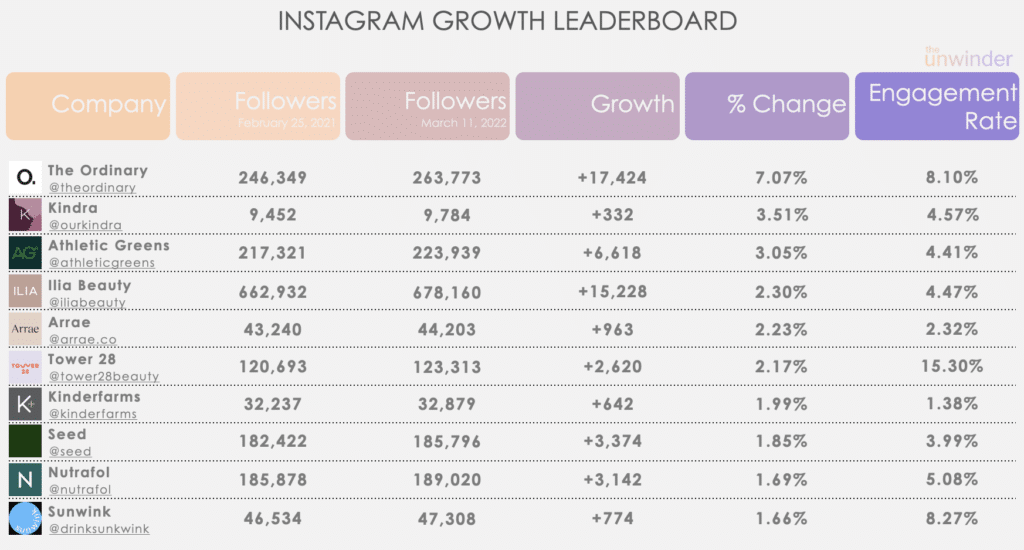

Instagram Growth Leaderboard

Kindra re-climbs the leaderboard, with a focus on organic community content. The Ordinary stays on top with what is likely strong social ad spending.