Executive compensation is a hot issue. On the one hand, it does not look good, in the face of glaring income inequality, that the average S&P 500 CEO makes 299 times more than their average worker. On the other hand, we celebrate the entrepreneurs who take risks and reap great rewards (at least, until they get too successful, and public sentiment turns). There is also a practical question: What is the right amount, and form, of executive compensation to make a company competitive and successful?

More specifically, how much do executives in the wellness industry make? Through a spate of recent “new wellness” IPOs, we can pull the data. U.S. public companies are required to disclose the compensation of their highest-paid executives.

Executive compensation at larger companies falls into a few buckets. Base salary is self-explanatory, and tends to be (relatively) modest. The next bucket is incentive compensation, which includes bonuses, performance-based stock grants, and stock options. Stock options are often awarded no matter what, based on the original contract, but being options, they have a “strike price”, only above which does the executive make money – hence the incentive to grow the stock price. Finally, there are the “perks”, which can include everything from health insurance to loans to housing.

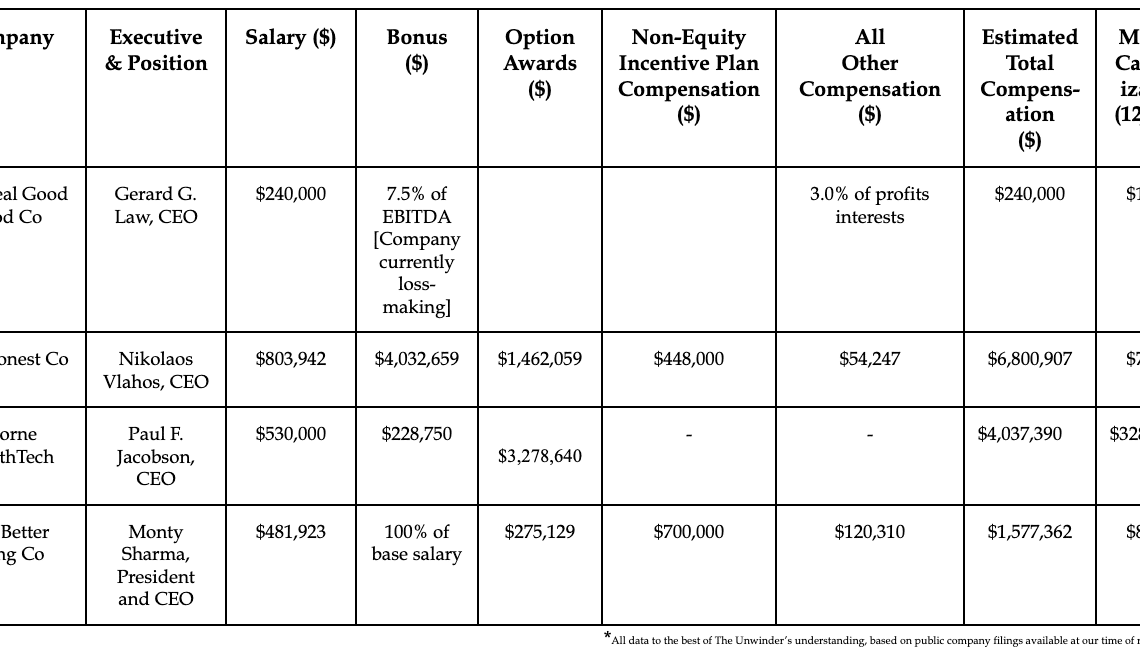

Here is a sampling of executive compensation at a few of the recent wellness IPOs we surveyed in our November 23rd newsletter:

Note that many of these executives also already own substantial equity in their companies, which they can sell. For example, Paul Jacobson of Thorne is on the record as already having significant vested options and total approximate pre-offering ownership of 12.2% of the company, which today should be around $40 million dollars (factoring in the dilution from the IPO offering).

Perks abound as well. Benefits like commuting stipends, health and life insurance, 401K top-ups, and housing were all included among the companies studied. One interesting case is Mr. Sharma of The Being Better Co. The company appears to spend ~$170K annually on leasing a private aircraft for him to commute from his Denver home to the company’s offices in Salt Lake City, and employs his wife to the tune of $200K a year.

Companies also provide various loans to their executives, including loans to pay AMT (taxes), and to buy their own stock options. Severance packages are a notable item as well.

You’ll see on the table, each executive package is unique, depending on company size, performance, whether it is founder-led or how much of the company the executive already owns, among other factors.

Executive Compensation In The U.S.

This sampling of new wellness exec comp is set against a background that has been very generous to CEOs of top U.S. firms. In 2020, CEO pay at the top-350 public U.S. firms grew 18.9%, to $24.2 million on average. However, a good deal of this increase may be in the increase in public market valuations, as the majority of CEO pay tends to be in various stock-based compensation.

In general, top companies are shifting from stock options to vested stock awards and exercised stock options. This is an incentive mechanism where executives get the right to exercise (buy) a set number of shares at a fixed price later on, for the purpose of encouraging (or making them) stay longer and perform well to earn that award.

Globally, there are large regional differences in how much top executives earn:

Executive Compensation And Performance

The big question is – do these large pay packages “work”? Generally speaking, there is a relationship between the ratio of long- versus short-term incentives and company or sector performance. The technology sector does the most long-term incentives and group-oriented goals, and has the best recent stock performance, while low-growth industries like Industrials and Utilities are cash- and short-term oriented.

However, it’s not totally clear which is cause and which is effect. Without wading too deep into a massively challenging issue, I believe that long-term incentives that align compensation to value creation are the way to go. For emerging wellness companies, considering value beyond short-term share price, like environmental and social goals, can have positive long-term effects. Beyond that, each company is its own, and hopefully this data helps.

24-Hour Fasting & An Interview In Levels

A slight break from our regularly-scheduled business news & analysis for a bit of shameless self-promotion:

Wellness has always been a big part of my personal life, but my journey took a turn when, through a friend in the startup world, I tried Levels continuous glucose monitor early last year.

Seeing a surprising level of insulin resistance prompted me to add once-weekly, 24-hour fasting to my regime. I wrote about my fasting experience, with research and results, here.

Levels, which has a fantastic blog, then interviewed me, providing a summary version of my article. Please check out both, and if 24-hour fasting interests you for your own health, I’m happy to talk!

Now, back to business:

News & Notes

Moon Juice is raising $7M to “expand to the interior of the U.S.” with it’s popular wellness-focused juice bars and products. $5.1M is committed thus far.

Golde, the superfood powder maker, will now be carried in Target.

Brown Girl Jane has launched a fragrance exclusively in Nordstrom. The company based their fragrance in neuroscience research.

Goop is in trouble in London, closing their flagship store after taking a reported 1.4M GPB loss

Thorne Healthtech is expanding into Asia via a joint venture with Japanese conglomerate Mitsui.

In a proof that the FDA doesn’t always say “no”, the agency just approved certain claims for magnesium supplements effects on blood pressure.

IL MAKIAGE, a new wellness-focused beauty brand, has raised $130M at a $1.5B valuation on $260M of revenue. IL MAKIAGE is said to be the first brand of Israeli parent company Oddity, who claim their customer-centric technology platform will enable them to launch more brands like it.

Body positivity-focused model and influencer Iskra Lawrence launches a new body-care brand, Saltair, out of ‘The Center’ brand incubator.

Two vitamin and supplement brands, Jarrow Formulas and Natrol, have merged to create a new company, Vytalogy Wellness.

Saks Fifth Avenue department store is (finally) jumping on the wellness trend by launching an in-store Wellness Shop.

Sayana, an AI-powered mental health and wellness startup, was acquired by Headspace.

Masters, a startup doing MasterClass for workouts, has raised a $2.7M seed round.

Galderma buys ALASTIN skincare, with price undisclosed. ALASTIN does better-for-you skincare sold through dermatologists and skincare professionals

Instagram Growth Leaderboard

Thanks to all who replied with feedback on this newsletter. One thing we heard loud and clear is that insights are everything when running a business. As such, we plan to build out our competitive intelligence tools for wellness businesses in 2022.

To start, we are adding Engagement Rate to our Instagram Growth tracker. We calculate engagement rate by adding Likes and Comments on the most recent 12 posts, then dividing that by total followers. The average engagement rate for this period was 5.98%.

Going forward we expect this metric to help us weed out those who are building genuine communities from those who are buying cheap, junky, or fake followers.